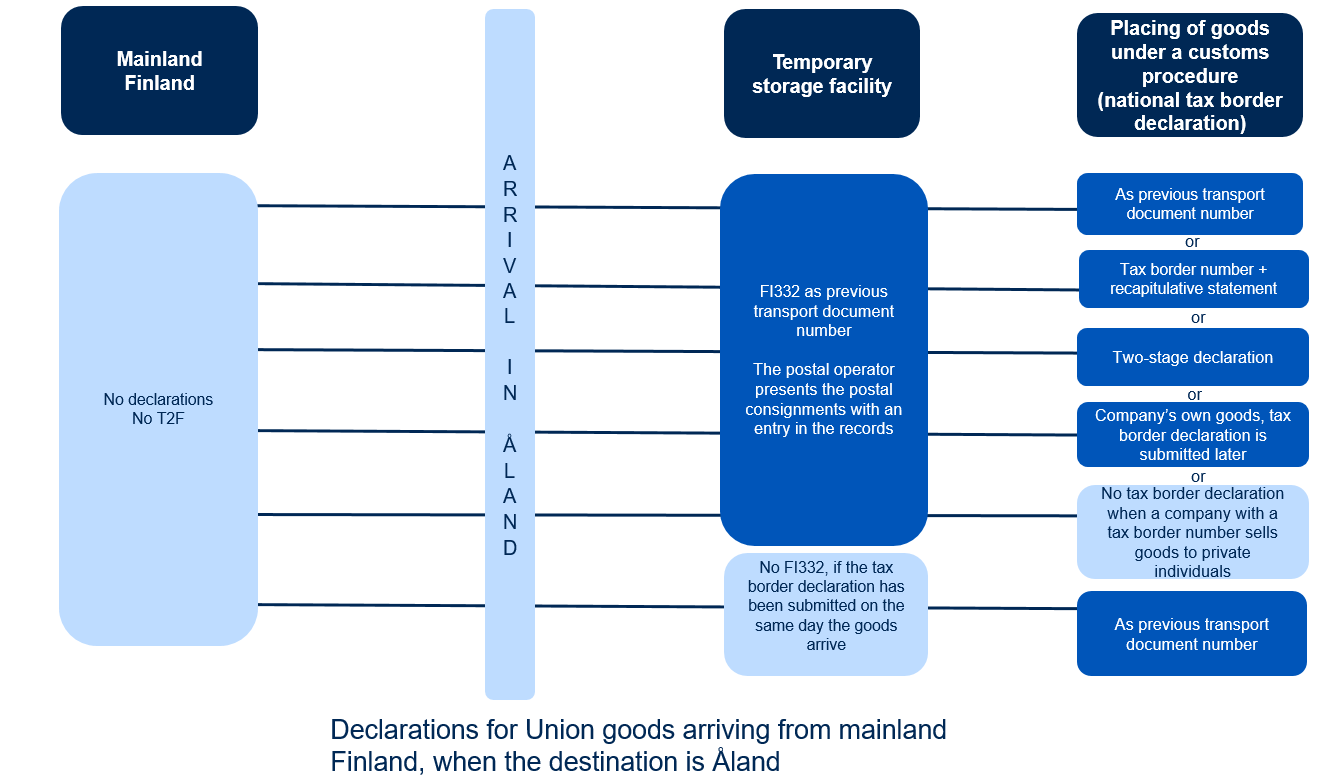

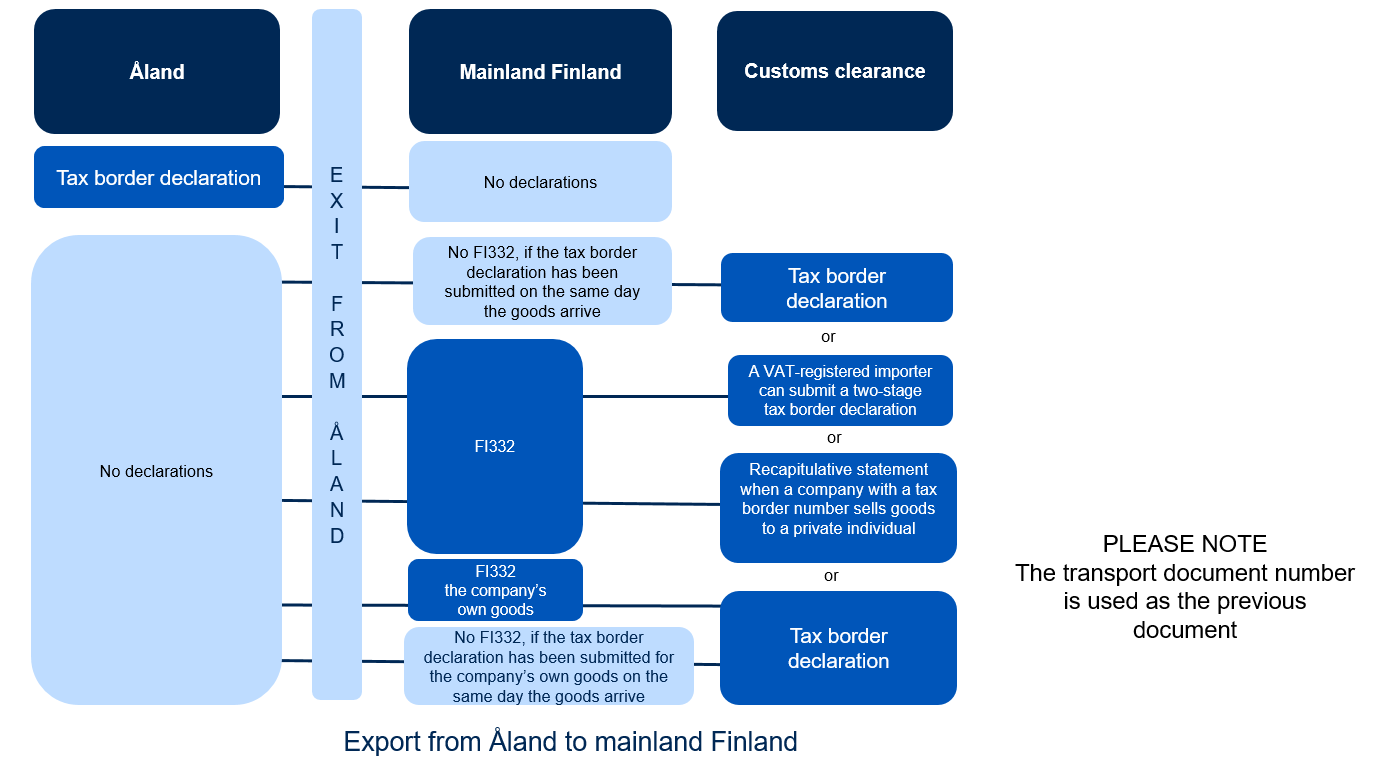

Goods traffic between Åland and mainland Finland

All goods transported from Åland to mainland Finland or from mainland Finland to Åland must be presented to Customs, and a national tax border declaration (customs declaration) must be submitted for them.

Presentation notification

- The person importing the goods across the tax border must present the arriving goods to Customs using a presentation notification, or, alternatively, using the customs declaration, in which case a separate presentation notification is not required.

- You can use a representative to submit the presentation notification.

Read more about the presentation notification

National tax border declaration (customs declaration)

The importer must submit a customs declaration for goods transported across the tax border between Åland and mainland Finland.

A company registered for VAT can submit the declaration in two stages or in one stage.

The importing company is responsible for submitting the declaration even if they use a representative to submit it.

Read more about the tax border declaration

Recapitulative statement for tax border customers (customs declaration)

- VAT-registered companies that sell goods to private individuals or to organisations or companies not registered for VAT can apply for status as tax border customers.

- Tax border customers submit the import declaration as a recapitulative statement on behalf of the private individual.

- The tax border customer acts as the exporter and is responsible for submitting the declarations.

Read more about applying for tax border customer status and the recapitulative statement

The tax border number is not mandatory for companies selling goods to private individuals or to organisations or companies not registered for VAT.

In such situations, the importer or representative submits a combined declaration for dispatch and import.

If the date when the declaration was lodged is the same as the arrival date, provide the arrival date as the tax determination date.

If you are pre-lodging a one-stage declaration, select the estimated date of arrival of the goods or the date when the goods cross the tax border. If the goods have already arrived across the tax border and you don’t know the date for that, provide the date when you submit the customs declaration.

If you are lodging a periodic declaration for a calendar month, you should provide the date of lodgement of the periodic declaration under “Tax determination date”.

If you are lodging a declaration for inward processing or for temporary admission, select the date of lodgement of the declaration as the tax determination date.

Consignors in Åland can lodge the required customs declaration, i.e. the national tax border declaration, with their own details under both “Exporter” and “Representative” and with the details of the consignee under “Importer”. The form of representation is direct representation.

A customs declaration must be submitted when exporting own goods across the tax border. The same party is to be provided as both the exporter and the importer in the declaration.

Read more

- Regulation 10/2022 of Finnish Customs on the customs clearance formalities for Union goods transported between the region of the Åland Islands and the rest of Finland (available in Finnish and Swedish)

- Newspapers and periodicals sent across the Åland tax border to non-VAT-registered persons in Åland from 1 July 2021 - description and legal basis (available in Finnish and Swedish)

- Åland tax border in value added taxation (published by the Tax Administration, available in Finnish and Swedish).