INF system for special procedures

Go to the INF system of special procedures

In the INF System for Special Procedures, you can apply for an INF number.

The applicant must have an EORI number.

Using the service requires identification. Users log into the service via the EU Trader Portal. To access the INF System for Special Procedures, choose “INF” in the EU Trader Portal menu. Read the guidance on logging in to the EU’s e-services.

In the service, you will need the Suomi.fi mandate “Applying for customs authorisations” to act on behalf of a company. Read more about granting mandates. Note that when using the EU’s e-service, the managing director of the company must also grant themselves a mandate in the Suomi.fi service to act on behalf of the company.

When is an INF number required?

You need and INF number for the inward and outward processing procedures:

- outward processing that starts with export (procedure code 21xx)

- inward processing that starts with prior export (procedure code 11xx)

- requires an inward processing authorisation granted by the Authorisation Centre

- outward or inward processing that starts with import and involves several Member States

- requires an authorisation involving more than one EU Member State for inward or outward processing

You must apply for the INF number before submitting a customs declaration. Note that Customs only processes electronic INF requests from Monday to Friday 8–16.15.

Please note: Private individuals don’t need an INF number for the procedure 21xx.

Example 1

A projector for which customs duty would be levied on import breaks down.The projector is going to be sent for repair outside EU under the outward processing procedure 21xx.

In this case, you must make an INF request before submitting an export declaration

In the INF request, provide the details of the defective projector you’re sending for repair. In the request, you must also provide the details of the repaired projector you bring back after the repair. The INF request receives an INF number that you must provide in both the export and import declaration.

Example 2

You have an inward processing authorisation involving more than one Member State. First, you import goods to Finland for processing and place them under the inward processing procedure. After that, the goods are intended to be moved under the inward processing procedure to Sweden for further processing there.The procedure started in Finland is going to be discharged in Sweden after further processing with re-export of the goods from the EU.

You must make an INF request for the goods and provide the INF number in the import declaration and re-export declaration.

When is an INF number not required?

- In inward processing that starts and ends in Finland.

Example 3:

You have an inward processing authorisation involving more than one Member State. First, you import goods to Finland for processing and place them under the inward processing procedure. After that, the goods are also intended to be moved under the inward processing procedure to Estonia for further processing there. After the processing, the goods will be brought back to Finland and the procedure will discharged with re-export of the goods from Finland to a country outside the EU.

In this case, you don’t need to request an INF number, because the inward processing starts and ends in Finland.

- In the temporary export procedures 22xx and 23xx. Read more on the page Temporary export.

- Private individuals don’t need an INF number for the procedure 21xx.

How request an INF number

If you apply for an authorisation for the outward processing procedure with a customs declaration, you must make a separate INF request for each export declaration.

If you have a written authorisation granted by the Customs Authorisation Centre, you can use the same INF number in more than one export or import declaration. This means that you can make a single INF request for goods to be exported or imported in several consignments. You can make an INF request, e.g. for the remaining quantity in the authorisation or for a quantity that corresponds to the requirement of the production management system.

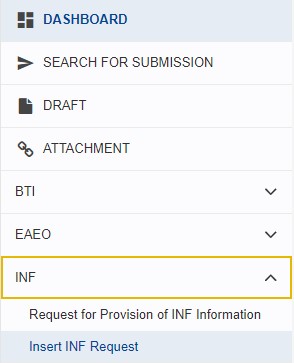

In the drop-down menu in the EU’s e-services, open “INF” by clicking on the arrow.

Choose “Insert INF Request”.

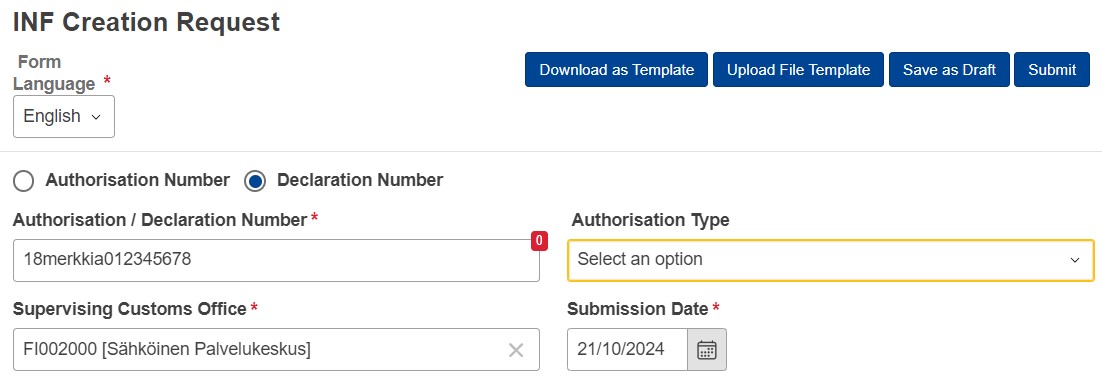

INF Creation Request

Choose English as the language.

Fill in the details related to the customs procedure.

If you have an authorisation involving more than one EU Member State or a written authorisation granted by the Customs Authorisation Centre for the processing procedure, choose “Authorisation Number”. Enter the authorisation number. A national authorisation cannot be found in the Commission’s system, so the system will display a remark about it, but you can still continue to complete the request.

If you apply for an outward processing authorisation with a customs declaration, choose “Declaration Number”. Enter the company’s own internal reference number, which must have exactly 18 characters. The reference number can contain numbers and letters. For example, if an invoice number is not long enough, enter enough zeros to make up the 18 characters. Enter all the characters typed together without spaces or Scandinavian characters.

Select the authorisation type.

- “OP EX/IM” is an authorisation for outward processing, which starts with export and ends with import.

- “OP IM/EX” is an authorisation for outward processing, which starts with import and ends with export.

- “IP EX/IM” is an authorisation for inward processing, which starts with prior export of equivalent goods and ends with import.

- “IP IM/EX” is an inward processing authorisation involving more than one EU Member State, which starts with import and ends with re-export in another Member State.

The system will generate the INF number based on the selected authorisation type and the information provided in the field “Authorisation/Declaration number”. However, the INF number won’t be generated until Customs has accepted and verified the request. This INF number must be provided in both export and import declarations with the additional document code C710.

For example, the INF number for outward processing beginning with export is generated as follows:

- If you have a written authorisation granted by the Authorisation Centre:

- In the INF request, you have chosen “Authorisation Number” and entered the authorisation number.

- The INF number consists of the selected authorisation type and the authorisation number. The INF number has the format OP EX/IM000001FIOPOL12345.

- If you apply for an authorisation for outward processing with a customs declaration:

- In the INF request, you have chosen “Declaration Number” and entered the your company’s own reference for the request.

- The INF number consists of the selected authorisation type and the company’s own reference you provided. The INF number has the format OP EX/IM000001+ your company’s own internal reference.

In the field “Supervising Customs Office”, always provide the Electronic Service Centre with the code FI002000.

Submission Date is the date of submission of the INF request.

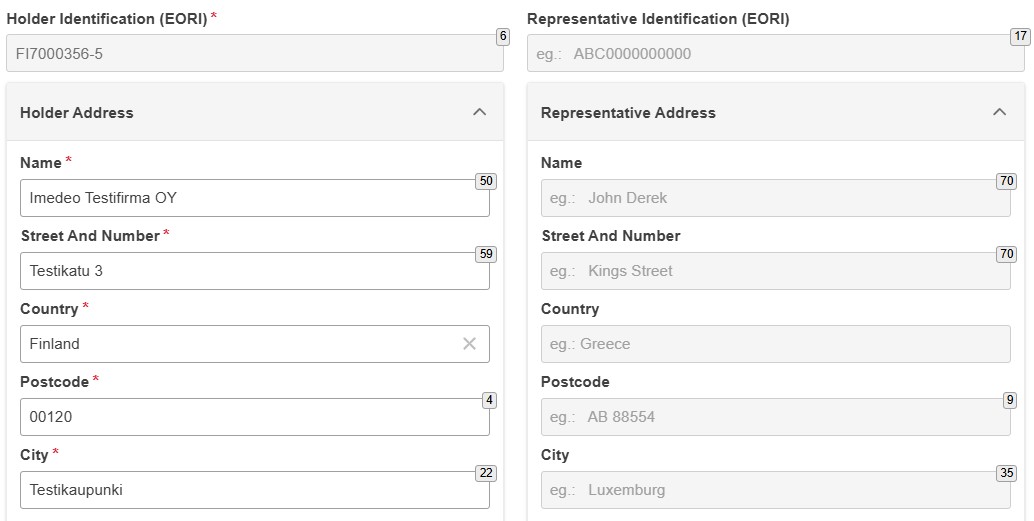

Identification details of the holder and the representative

The identification details of the holder and the representative come automatically from the EORI register. Check that the details are correct. The holder’s details must contain the authorisation holder’s details.

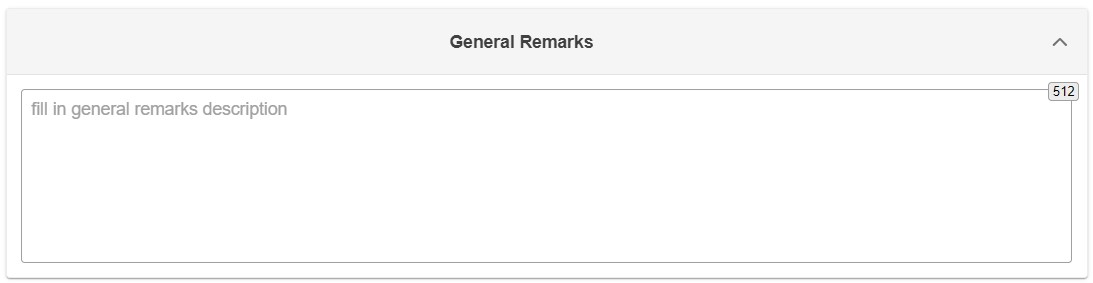

General remarks

In the field “General remarks”, you can type remarks related to the request.

Please note: Fill in your name, email address and phone number here so that Customs can contact you if needed.

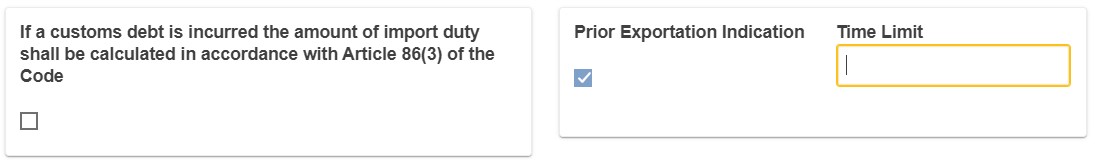

A field concerning the customs debt article will be displayed in the request if you selected inward processing as the authorisation type. The customs debt article is indicated in accordance with the inward processing authorisation. If the customs debt is determined in accordance with Article 86(3) of the UCC, tick the box. If the customs debt is determined in accordance with Article 85 of the UCC, don’t tick the box.

The field “Prior export indication” will only be activated if you selected IP EX/IM as the authorisation type. In that case, you should also enter the time limit for importing the third country goods for which a right of import arises to the Union.

What details of the goods must be provided in the INF request?

In the INF request, details of the goods must be provided under “Goods covered by the INF” and “Processed products covered by the INF”. Note that the value and commodity code may differ between these

- Under “Goods covered by the INF”, you should provide

- e.g. in outward processing, materials exported for processing (such as raw materials intended for production of the product) or a defective device sent for repair.

- As the value, use the value of the exported materials or of the defective device at the time.

- e.g. in outward processing, materials exported for processing (such as raw materials intended for production of the product) or a defective device sent for repair.

- Under “Processed products covered by the INF”, you should provide

- e.g. the processed product or repaired device returning from outward processing.

- As the value of the processed products, provide the total amount including the value of the goods exported for processing, the processing costs as well as the import freight costs, if any.

- e.g. the processed product or repaired device returning from outward processing.

Some of the details can be estimates. If you don’t know the exact value, you should provide a higher rather than lower estimate. Finnish Customs monitors that the quantity and value details provided in customs declarations don’t exceed the details provided in the INF request.

Pääset lisäämään INF-pyyntöön tavaroita sivulla "INF:n kattamat tavarat" valitsemalla "+Lisää". Jos pyyntö sisältää useiden eri nimikkeiden alla olevia tavaroita, voit ladata tiedot INF-pyyntöön CSV-tiedostona. Valitse silloin kohta "Lataa itsellesi mallipohja". Mallipohja on Excel-taulukko, joka muunnetaan CSV-tiedostoksi. Katso tarkemmat ohjeet tältä sivulta kohdasta "CSV-tiedoston ja mallipohjan käyttö". Huomioi, että INF-pyyntöihin ei voi enää toimittaa paperisia liitteitä.

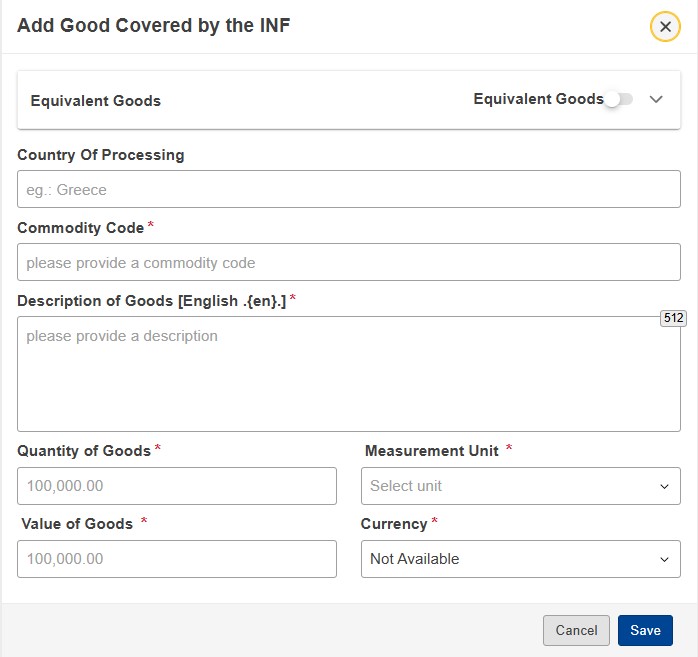

In outward processing, add the following details of goods covered by the INF:

- provide the country of processing, if the processed product returns after processing to a different Union country than where placement under the outward processing procedure was carried out

- requires a written authorisation involving more than one Member State

- the 8-digit commodity code of the goods

- as the description of goods either

-

- the goods description indicated in the authorisation granted by the Authorisation Centre or

- the trade name or technical description of the goods, if authorisation for the special procedure is applied for with a customs declaration.

- as the quantity of goods for goods covered by the INF either

- the exported quantity covered by a single customs declaration or

- the remaining quantity in the authorisation granted by the Authorisation Centre.

- measurement unit (indicated in the authorisation)

- the value of the materials or goods placed under processing and the currency (in euros)

Save the details you have provided.

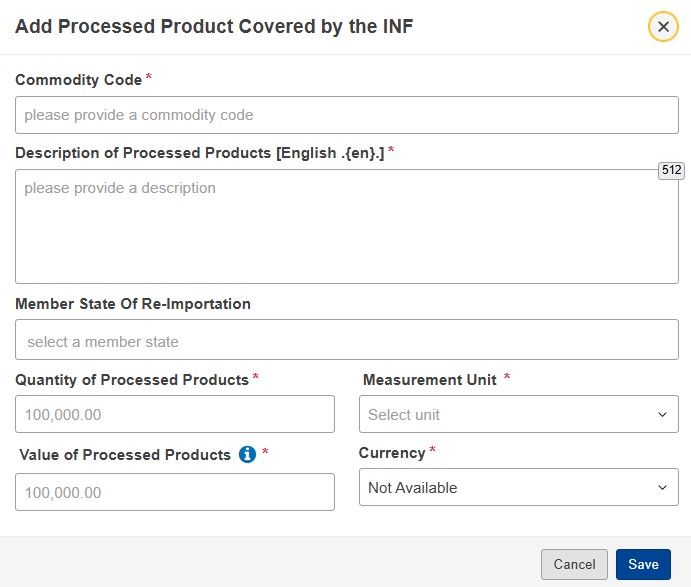

After this, provide the details of the products produced under outward processing or returning after repair under “Processed products covered by the INF” by clicking on “+Add”.

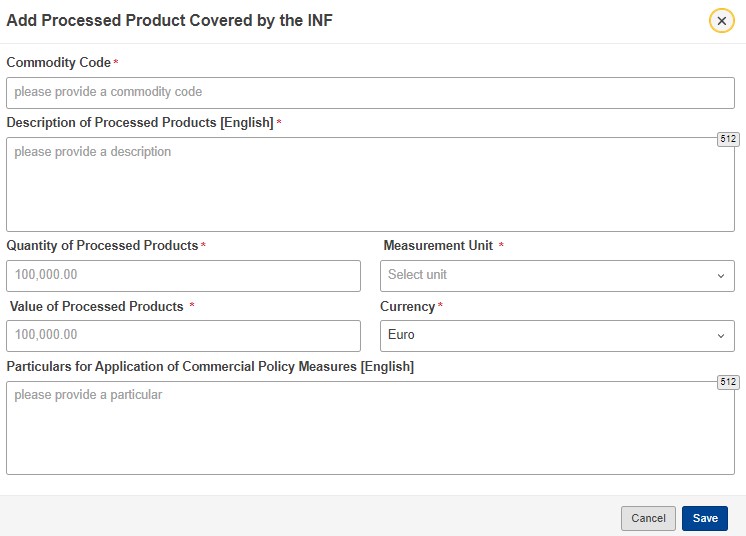

Add the following details of processed products covered by the INF:

- the 8-digit commodity code of the finished product produced under outward processing.

- as the description of goods either

- the goods description indicated in the authorisation granted by the Authorisation Centre or

- the trade name or technical description of the goods, if authorisation for the special procedure is applied for with a customs declaration.

- provide the Member State of re-Importation, if the processed product returns after processing to a different Union country than where placement under the outward processing procedure was carried out.

- requires a written authorisation involving more than one Member State

- quantity of processed products

- From the drop-down menu, choose the measurement unit used in the records of finished products. If the company has a written authorisation granted by the Authorisation Centre, the measurement unit indicated in the authorisation must be used.

- the estimated value of the processed product and the currency:

- In outward processing, the value of the processed products consists of the value of the exported goods, the processing costs and the import freight. Please note that the value is usually higher than the value of the goods sent for processing under “Goods covered by the INF”.

Save the details you have provided.

Inward processing that starts with prior export of goods produced from equivalent goods and ends with import always requires a written authorisation granted by the Authorisation Centre. The authorisation must permit the use of equivalent goods as well as prior export. The authorisation indicates the equivalent goods that the company can use.

When you export goods using prior export under inward processing, make a separate INF request for each export declaration (customs procedure 1100 999). One INF number obtained for prior export can cover several import declarations (customs procedure 5111 999). However, you must ensure that the six-month time limit for the procedure according to the authorisation is not exceeded and that you don’t import more non-Union goods than is permitted by the right of import.

Example 4

100 kg of strawberry jam is exported using prior export under inward processing (customs procedure 1100 999), and equivalent Union goods (50 kg of Union sugar) have been used in the production of the jam. Based on the export of the strawberry jam, a right of import arises for the same quantity of non-Union goods, i.e. for 50 kg of non-Union sugar. In this example, the “processed product covered by the INF” is 100 kg of strawberry jam exported using prior export.

Example 5

A new intact device (equivalent Union goods) is sent from Finland to a customer using prior export under inward processing (customs procedure 1100 999) to replace the customer’s broken device. Based on the prior export, a right of import arises for the same quantity of non-Union goods, i.e. for the customer’s broken device. This broken device is imported to Finland and declared using the procedure code 5111 999. In this example, the “processed product covered by the INF” is the new intact device sent as equivalent goods using prior export.

How to add details of goods to an INF request for prior export of equivalent goods under inward processing

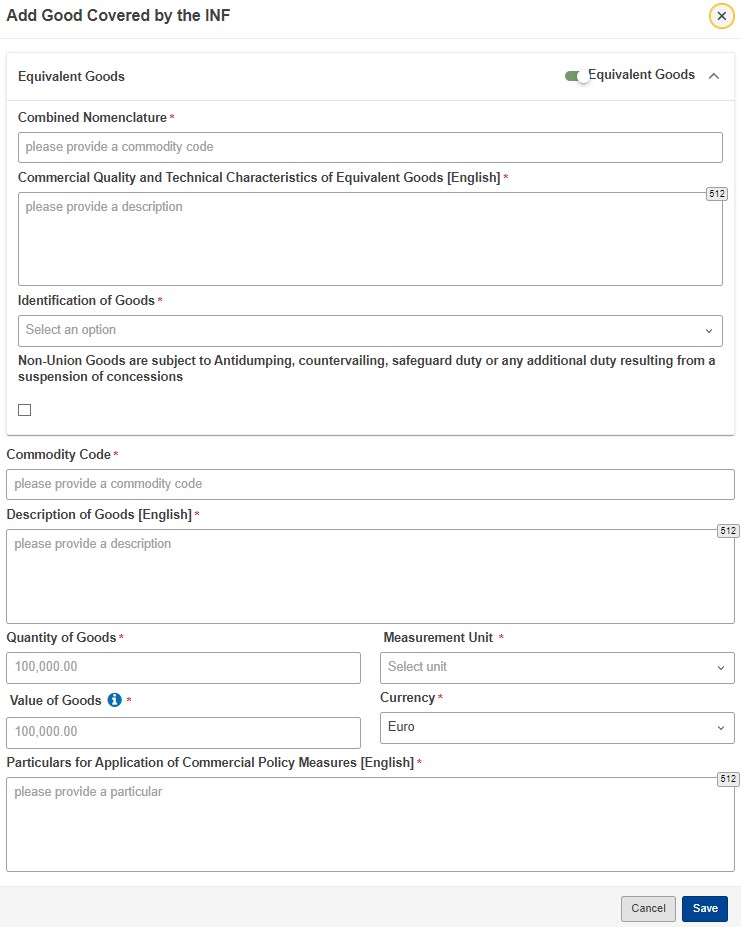

Go to the page “Add Good Covered by the INF” and make sure that “Equivalent Goods” in the top right corner is checked.

Provide here first the equivalent goods as indicated in the authorisation. In the INF request regarding the IP EX/IM authorisation, enter the Union goods used in the production of the processed product. In example 4), 50 kg of Union sugar is provided and in example 5), the Union goods exported to replace the broken device are provided. Provide the following details of the equivalent goods:

- the commodity code at eight-digit level in accordance with the authorisation

- the description of goods in accordance with the authorisation

- select the identification of goods from the drop-down menu.

- Tick the box below if the non-Union goods in the declaration instead of which equivalent goods are used are subject to anti-dumping or other equivalent measures.

Next provide the details of the non-Union goods imported to the Union for which a right of import arises. In example 4), 50 kg of non-Union sugar is provided and in example 5), the broken non-Union device.

- the commodity code at eight-digit level in accordance with the authorisation

- the description of goods in accordance with the authorisation

- under “Quantity of Goods” and “Measurement Unit”, enter the quantity of non-Union goods for which a right of import arises and the measurement unit. From the dropdown menu, select the measurement unit in accordance with the authorisation.

- under “Value of Goods” and “Currency”, provide an estimate of the value (in euros) of the non-Union goods for which a right of import arises.

- any commercial policy measures associated with the goods.

Save the details you have provided.

When the equivalent goods have been provided in the INF request, a tick mark is displayed under the heading “Use Equivalent Goods” at the beginning of the row.

.jpg/fc8434f7-a241-356e-8f4e-fcd04d32e83f?t=1738241879734)

Add processed product covered by the INF

In the INF request regarding the IP EX/IM authorisation, enter here the finished products provided in the export declaration, produced using Union goods. In example 4), 100 kg of strawberry jam exported using prior export and in example 5), the device exported using prior export to replace the broken device.

Save the details you have provided.

The details provided in the INF request must match the details of both the export declaration and the authorisation. A separate INF request must be made for each export declaration with the procedure (11xx). In the INF request, use the measurement units indicated in the authorisation. Please note that the quantity and value details provided in the INF request must be provided in the export and import declaration with the additional information code FI710, so that Customs can make the entries concerning the INF number in accordance with the details you have provided. You can read more under “How can I view the details of my INF requests or follow the processing of them”.

For Customs’ entries, provide the following INF number-related details in the goods item details in the export declaration (customs procedure 1100 999):

- the INF number as an additional document with the code C710.

- the commodity code, quantity and value of the equivalent Union goods with the additional information code FI710.

- the quantity and value of the processed products with another additional information code FI710.

For Customs’ entries, provide the following INF number-related details for each goods item in the import declaration (customs procedure 5111 999):

- as additional documents with the code C710, all INF numbers concerning the goods item, based on which you indicate that a right of import has arisen for the non-Union goods.

- with the additional information code FI710, the quantity and value details by INF number provided for the goods imported with INF number. For example: “FI710 / IP EX/IM…, 250 kg, 2000 EUR”.

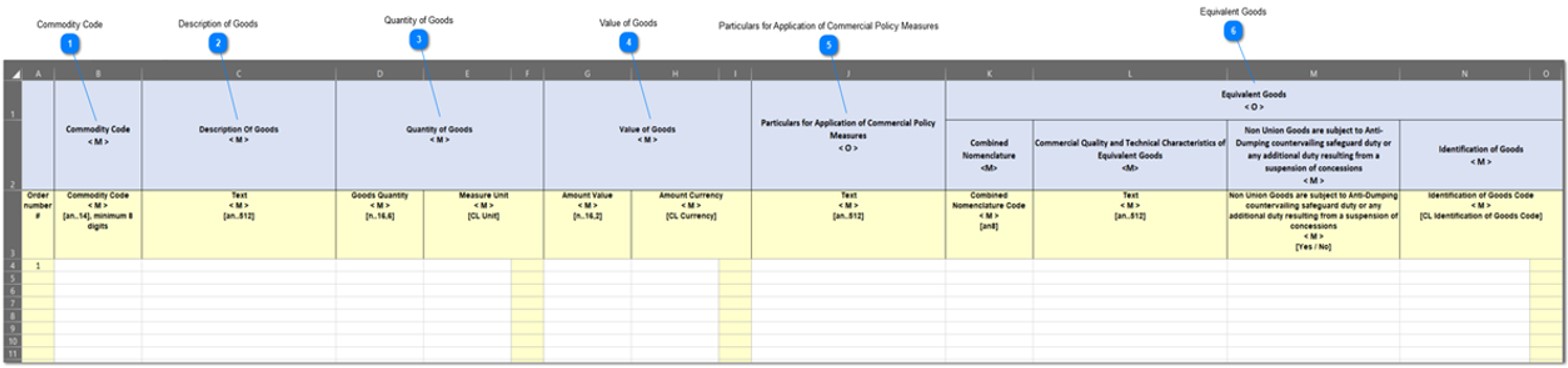

You can download the template as an Excel file on the page “Insert INF Request” by clicking on “Download Template”. In the file, there are certain fixed columns and sheets that help you upload several goods at the same time to the INF request. You should also note that the template can be different depending on the authorisation type and that the system does not accept a template intended for another authorisation type. You should also note that the template can be different depending on the authorisation type and that the system does not accept a template intended for another authorisation type.

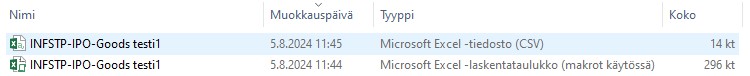

The Excel file can only be converted once into the CSV file format. That is why you should make several copies of the template, which you can later convert into CSV files. The converted templates are locked and cannot be edited further.

The Excel file contains four different sheets. The first sheet contains important information on how to fill in the form correctly. The second sheet is the actual form and the third sheet has a function button for converting the Excel file into a CSV file. The fourth sheet contains the data that can found in the drop-down menus of the actual sheet (auxiliary sheet).

An Excel file containing several goods can look like this:

In the sheet marked “Fill in this sheet”, fill in all the details to be transferred, row by row.

- The 8-digit commodity code of the goods

- Goods description according to the trade name or the authorisation

- Goods quantity and measurement unit in accordance with the authorisation

- Value of the goods per commodity code and currency (euros) of the provided value

- Particulars for application of commercial policy measures

- Additional details of equivalent goods (if you use equivalent goods)

Please note: Columns with the letter <M> are mandatory and columns with the letter <O> are optional. If you are using equivalent goods, the details in the column <O> are mandatory. All details displayed in the popup window that opens by clicking on “+Add” must be entered in the sheet.

- After filling in the data, save the Excel file in your own file folder.

- After saving it go to the sheet marked “Save this sheet as CSV”. The system creates a new Excel sheet in CSV format in the file folder where you saved the original Excel sheet.

The file is shown as an Excel(CSV) file, which you can move to the INF request by clicking on “Upload CSV File”. Successful upload of the CSV data required in the INF request is indicated with a green tick mark at the beginning of the row. The CSV file to be uploaded deletes from the data field the CSV file you previously uploaded or the details you saved by clicking on “+Add”

By clicking on “Delete”, you can delete single rows in the uploaded CSV file. If you notice that a goods item is missing from the uploaded CSV file, you can add it to the request by clicking on “+Add”.

If you notice that a goods item is missing from the uploaded CSV file, you can add it to the request by clicking on “+Add”. The button “+Add” will not delete the goods rows uploaded earlier as the CSV file.

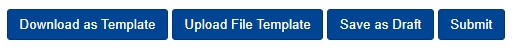

- If you have to search for additional information for the request, you can save the request as a draft.

- You can save the request on your computer by clicking on “Download as Template”.

- You can save the request as an XML file by clicking on “Upload File Template”.

- You can send the completed INF request by clicking on “Submit”.

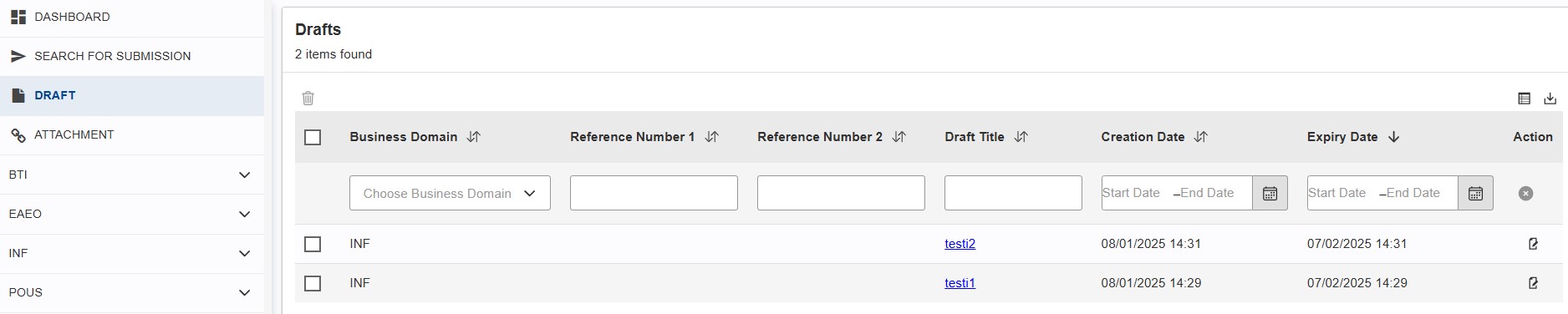

Saving as draft and editing the draft

If you can’t fill in the whole INF request in one go, you can fill in part of the mandatory details and save the incomplete request as a draft by clicking on “Save as Draft”.

The system opens a popup window. You will receive a notification that the draft was submitted successfully. You will receive a notification that the draft was submitted successfully.

When you wish to continue filling in the INF request, select “Draft” from the main menu; this opens the menu below.

You can edit the draft either by clicking on the Draft title or the edit icon in the Action column. The draft is opened for editing of the INF request.

You can add or edit the goods-related details in the draft and then send the completed INF request to Customs. Please note that you can’t change the details of the authorisation or the holder in the draft. With “Save as Draft”, you can make several similar INF requests. You can also save a new draft version of the draft. An edited draft sent to Customs does not delete the original draft; instead, you can use the same draft template again.

Amendment before submitting the request

If you notice, before submitting the INF request, that some detail you’ve provided is incorrect, click on “Edit” next to the row you wish to edit. The details are opened in a popup window, where you can edit them. Remember to save the details again.

If you notice that there are extra goods rows in the request, you can delete them by clicking on “Delete”.

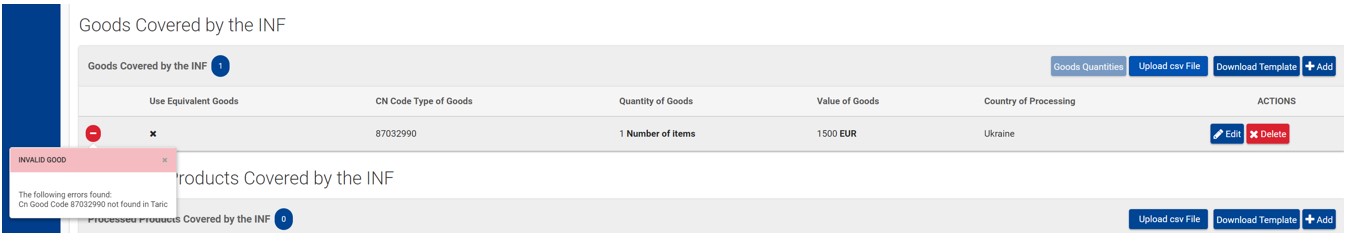

Error notifications displayed in the service

If the service detects errors in the request, it will notify you of them as follows:

- The field with incorrect data will be highlighted with yellow and an error text will be displayed below the field.

- A pop-up window describing the error opens at the bottom of the page.

- In a CSV file, a red error notification icon will be displayed next to the row in question. If you click on the error notification icon, the reason for the error will be displayed.

You can amend the errors by clicking on “Edit”. Amend the errors and save.

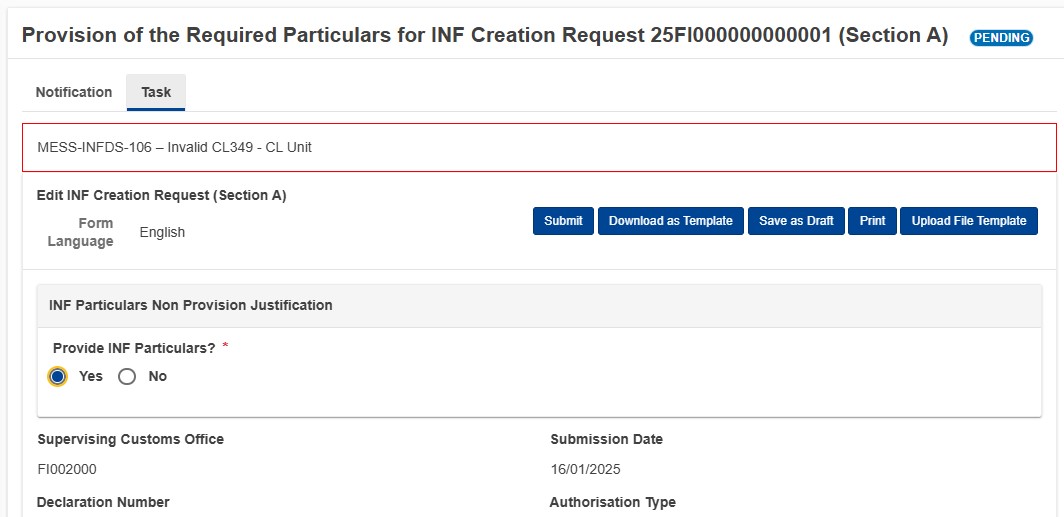

Error notification when submitting the request

The submission of your INF request may fail if you haven’t chosen the request language or if you have left out some details. In that case, a red error notification will be displayed in the bottom corner of the page. The system won’t submit the request until you have completed it.

After submission, on the “Dashboard” screen, you may have a “Task” to supplement your INF request, if there are errors in it. Open the “Task”, amend or supplement the requested detail and “Submit”. If you leave out some of the requested particulars, choose “No”. In that case, you must provide a justification.

INF reference number

When the request has been received a reference number is generated for it and you will be notified of that on the start page of the e-service. The INF reference number functions as a unique identifier for this request until the INF number is created.

Please note: The INF reference number is not the same as the INF number that you provide in the customs declaration. The INF number to be provided in the customs declaration is created for the INF request once it has been accepted by Customs.

If you notice, after submitting your INF request, that you have provided incorrect details in the request, e.g. regarding the value or quantity of goods, you can in some cases request amendment of the INF request.

Amending the INF details before certification of exit of the export declaration for outward processing

The condition for amending the details in an INF request is that certification of exit of the export declaration has not yet been made, that is, the goods have not exited the EU. If the details in the export declaration also need to be amended, request this amendment first. In the amendment request, you should indicate the need to amend the INF details. Read more about amendment of an export declaration.

By email you can request amendment of the details of the goods or the processed product covered by the INF for outward processing, such as the commodity code or details relating to quantity or value.

If the consignment is urgent, you should make a completely new INF request. If you have made a new INF request, provide the new INF number in the request for amendment of the export declaration. The goods must not exit the customs territory of the EU until Customs has approved the amendment of the export declaration.

Amending the INF details after certification of exit of the export declaration

By sending an email to Customs, you can request amendment of the details of an INF request for outward processing regarding import, that is, the details of the processed product covered by the INF. Here, the processed product covered by the INF refers to the processed product imported back to the Union after processing. In each individual case, Customs considers whether an error can still be amended.

If certification of exit of the export declaration has already been made, the details of an INF request regarding export, that is, the details of the goods covered by the INF, can no longer be amended. Here, the goods covered by the INF refer to goods/materials to be sent for outward processing that have been provided in the export declaration. For more instructions, see: “What should I do if fewer goods were provided in the INF request than in the export declaration?”

Details to be provided in the amendment request

The amendment request sent by email should contain the INF number (or the INF reference number) that the amendment concerns. Clearly indicate the original detail and how you wish to amend it. You should also give the reason for the amendment. If several rows should be corrected, enter the information e.g. in Excel format. Send the amendment request to INFmuutospyynnot@tulli.fi.

Example of an email request for amendment of INF details of goods imported after outward processing:

“Amendment request for INF number OP EX/IMxxxxx…

We have provided the processed product: commodity code “87032390”, goods description “passenger car”, value ”10 000 euros”.

According to information we have received, the value of the processed product we provided is incorrect. This is because the repair costs of the goods were 5 000 euros higher than estimated.

We request that the value of the processed product with INF number OP EX/IMxxxxx be amended to 15 000 euros.”

If you haven’t received approval of your INF request from Customs and the INF number within three days, you should first check the “Supervising Customs Office” you provided in the request.

- The “Supervising Customs Office”, must always be FI002000 Electronic Service Centre.

- If some other customs office has been entered in the field, the request will not be processed by Customs at all.

- Make a completely new INF request with the correct details.

If you have received a rejection notification from Customs regarding the INF request, and the reason for the rejection is unclear to you, you should contact Customs Business Information at yritysneuvonta@tulli.fi.

A rejected INF request can’t be amended, so you should make a new INF request with amended details. Provide your contact details in the field “General remarks” of the request, so that Customs can contact you if needed.

How to provide the INF number in export and import declarations

Provide the INF number in export and import declarations with the additional document code C710. For example, in the import declaration for outward processing, you can provide several export declarations as well as INF numbers with which the goods were exported for processing.

- If you have a written authorisation granted by the Authorisation Centre:

- In the INF request, you have chosen “Authorisation Number” and entered the authorisation number.

- The INF number has been made up of the selected authorisation type and the authorisation number. For example, in outward processing beginning with export, the INF number has the format OP EX/IM000001FIOPOL12345.

- If you apply for an authorisation e.g. for outward processing with a customs declaration:

- In the INF request, you have chosen “Declaration Number” and entered the your company’s own reference for the request.

- The INF number has been made up of the authorisation type selected for the request and the company’s own reference you provided. For example, in outward processing that has begun with export, the INF number has the format OP EX/IM000001+ your company’s own internal reference.

Provide the quantity details as follows:

- In the export declaration, as additional information at goods item level, with the additional information code FI710, provide the quantity details for the INF number (quantity and measurement units) as well as the value of the goods to be processed. For example: “FI710 / OP EX/IM001…, 1 piece, 1 500 euros”

- In the import declaration, for each goods item, provide the quantity details for the INF number (quantity and measurement unit) as well as the value of the processed goods with the additional information code FI710. The value of a processed goods item consists of the value of exported goods, the processing costs and the import freight. For example: “FI710 / OP EX/IM001…, 1 piece, 1 500 euros”

- If one goods item has e.g. three INF numbers, provide the quantity and value details for the goods item with three additional information codes FI710, i.e. separately for each INF number. Customs registers the quantity and value details for each INF number according to the customer’s declaration.

- If materials were exported e.g. with three INF numbers, but the processed products are imported with only one INF number, provide the quantity and value details with one additional information code FI710. Indicate clearly which INF number the details concern.

If the INF number is missing or the export is cancelled

If the INF number is missing from your export declaration, the processing of the declaration will be interrupted. In that case, make an INF request immediately and provide the INF number you receive in the export declaration.

If the export is cancelled and the goods don’t exit the EU, there is no need to request invalidation of the INF number; it can remain unused. You must, however, request invalidation of the export declaration

If too few goods were provided in the INF request, the processing of the export declaration will be interrupted. You must make a new INF request for the correct quantity of goods and provide the new INF number in the export declaration.

If you have a written authorisation granted by the Customs Authorisation Centre, you should do this:

- If the missing goods are mentioned in the authorisation, make a separate INF request for them or ask Customs to add the missing goods to the INF number by sending an amendment request by email to INFmuutospyynnot@tulli.fi. If the consignment is urgent, you should make a new INF request for the missing goods. In that case, provide the new INF number in the export declaration.

- If the goods are not mentioned in the authorisation, a separate INF request and export declaration must be made for them. Make the INF request first. When the INF request has been approved, make a new export declaration, where you provide the goods covered by the INF number as well as the INF number. This new export declaration also serves as an application for the outward processing authorisation. Contact the Customs Authorisation Centre for a possible amendment of the authorisation.

If certification of exit of the export declaration has been made, the details of the exported goods covered by the INF can no longer be amended.

Read more about retrospective declarations and amendment of an export declaration.

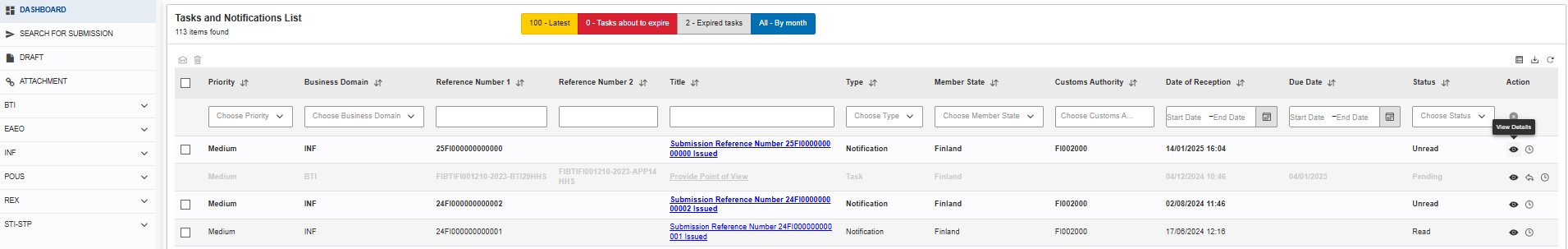

By clicking on “Dashboard” in the service, you can see all the INF requests you have made. You can view a single request by clicking on the reference number in the “Title” column or the “View Details” icon in the “Action” column. You can view an INF request you have submitted by opening the “Additional Information” tab and clicking on “View INF Creation Request”. In an approved INF request, the “Additional Information” tab has the button “View INF Information”.

Customs approves or rejects the INF request. This is indicated by “Approved” or “Rejected” in the “Title” column. For an approved request, the “Reference Number” column will display the INF number, which for an OP EX/IM request has the format OP EX/IM001…

Details of the INF number

If you wish to view the details of a confirmed INF number, you should first click on “INF” on the start page of the service and then on “Request for Provision of INF Information”.

Enter the INF number confirmed by Customs (e.g. IPEX/IM111DE....) the details of which you wish to view and click on “Submit”.

- If no information is found on the number, you will receive the notification “INF number does not exist”.

- If the number is correct, you can view the details of the request.

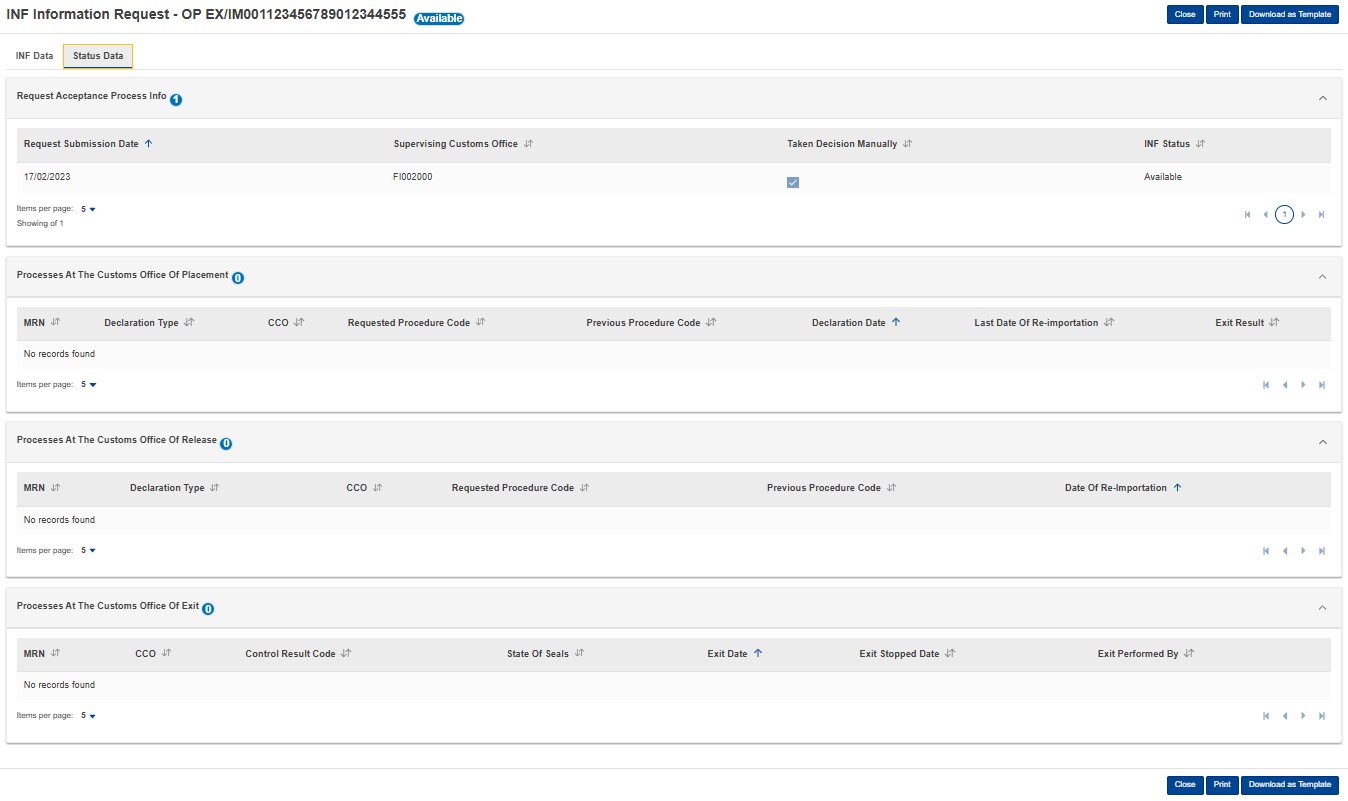

In the “INF Data” tab, you can view the general details of your request.

In the “Status Data” tab, you can see how your INF request has been processed.

The above INF request has been approved by Customs and is available. Customs hasn’t made any entries concerning this INF number. You can close the screen or print out the details on the page for yourself. You can also make a template for later use by clicking on “Download as Template”.

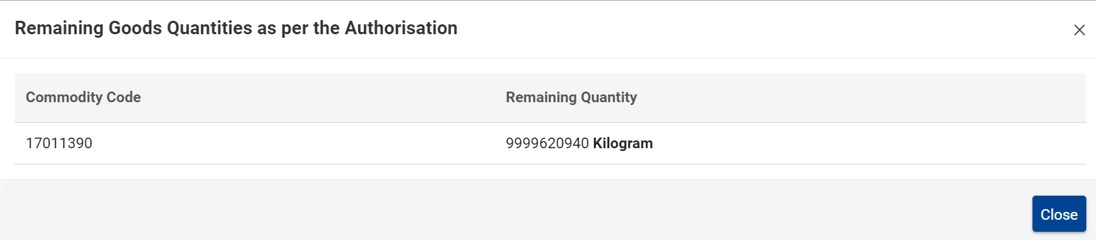

If your authorisation for special procedure involves more than one EU Member State and the system has found the authorisation details in the Commission’s systems with the authorisation number, you can check the remaining goods quantity in the authorisation. In the INF request, under “Goods covered by the INF”, you can then click on “Goods Quantities”.

The popup window that opens shows, per commodity code, the remaining goods quantity in your authorisation involving more than one EU Member State. You can also see the measurement unit of the goods.