I am going to order goods from abroad

Before you order goods to Finland, make sure that it is allowed.

The country of dispatch affects whether the parcel must be declared. Using the Customs Duty Calculator, you can estimate the amount of import duties and taxes you have to pay for the goods if the parcel needs to be declared.

Please note that if you order goods from outside the EU, the goods may not be safe. Read more about the safety of goods.

If you receive an arrival notice from Posti or some other transport company concerning a parcel to be declared, declare the parcel and pay the import taxes if needed. Read more about how to declare a parcel.

Parcel from outside the EU, for example from China or the United States

- The parcel must be declared.

- Payment of value added tax is required.

- Customs duty must be paid if the price of the purchase exceeds 150 euros excluding transport costs.

- As of 1 July 2026, customs duty must be paid for all consignments. Read more in our notice.

- For example, alcoholic beverages are subject to excise duty.

Parcel from inside the EU territory, but from outside the EU fiscal territory, for example from the Åland Islands or Canary Islands

- The parcel must be declared.

- Payment of value added tax is required.

- You do not have to pay any customs duty.

- For example, alcoholic beverages are subject to excise duty.

Parcel from within the EU, for example from Germany or the Netherlands

- The parcel does not need to be declared.

- Payment of value added tax is not required.

- You do not have to pay any customs duty.

- For example, alcoholic beverages are subject to excise duty.

What do import duties consist of?

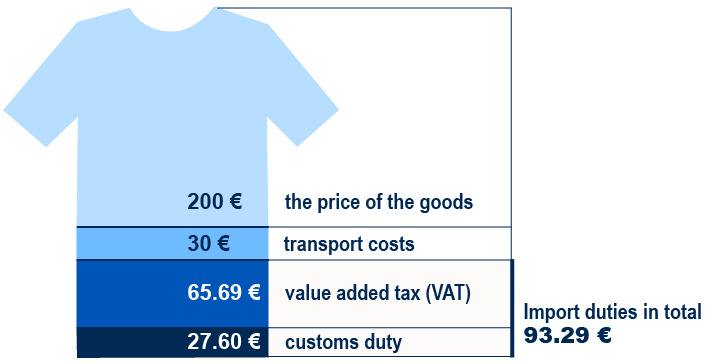

Customs duty

A parafiscal charge that you may have to pay when you declare goods. The amount of the customs duty depends, among other things, on which goods are in question, the country in which they were manufactured and from where they were dispatched, the value of the goods and the transport costs of the goods.

Value added tax (VAT)

A tax, which usually must be paid when you declare goods. The VAT is usually 25.5 per cent of the price of the goods, transport costs and other import duties.

Check if your country of residence is outside the EU.

Please note that if the parcel arrives from Northern Ireland, which is part of the United Kingdom, the same instructions apply as for parcels arriving from the EU.

Note that Posti or some other transport company however sees to customs clearances of most IOSS consignments.

If the online store is under the IOSS system, you do not usually have to pay VAT in connection with customs clearance, as you already pay it when you pay for your purchase.

Please note the following:

Please note the following:

- You don’t have to pay any customs duty

- for goods under certain commodity codes

- for goods manufactured in certain countries for which you can receive a preferential treatment and for which you have a preferential document.

- Customs duty must be paid for the following products, even if the value of the consignment is 150 euros or less:

- alcohol

- perfumes and eau de toilette products

- If you order goods from the USA, in addition to the payment for the goods and transport costs, you may have to pay an additional customs duty. Read more about the additional customs duty and when it enters into force.

Read more about excise taxation on the Tax Administration’s websiteLinkki toiselle sivustolle.

Check if your country of residence is part of the EU.

Note that if your order a parcel from Helgoland or Büsingen in Germany, from Livigno in Italy or from Ceuta or Melilla in Spain, the same instructions apply as to parcels that arrive from outside the EU. This is because the said regions are not within the customs and fiscal territories of the EU.

Note that a parcel you order from within the EU must be declared in the following situations:

- You order a parcel from within the EU territory, but it is sent to you from outside the EU.

- You order a parcel from within the EU territory, but the goods were manufactured outside the EU and the seller has not declared the goods for entry to the EU.

- You order a parcel from Helgoland or Büsingen in Germany, from Livigno in Italy or from Ceuta or Melilla in Spain. These regions are not within the customs and fiscal territories of the EU.

Note that you must pay VAT for a parcel you order from within the EU in the same way as for parcels ordered from outside the EU in the following situations:

- You order a parcel from within the EU territory, but it is sent to you from outside the EU.

- You order a parcel from within the EU territory, but the goods were manufactured outside the EU and the seller has not declared the goods for entry to the EU.

- You order a parcel from Helgoland or Büsingen in Germany, from Livigno in Italy or from Ceuta or Melilla in Spain. These regions are not within the customs and fiscal territories of the EU.

Note that you must pay customs duty for a parcel you order from within the EU in the same way as for parcels ordered from outside the EU in the following situations:

- You order a parcel from within the EU territory, but it is sent to you from outside the EU.

- You order a parcel from within the EU territory, but the goods were manufactured outside the EU and the seller has not declared the goods for entry to the EU.

- You order a parcel from Helgoland or Büsingen in Germany, from Livigno in Italy or from Ceuta or Melilla in Spain. These regions are not within the customs and fiscal territories of the EU.

Read more about excise taxation on the Tax Administration’s websiteLinkki toiselle sivustolle.

Note that you must pay customs duty for a parcel you order from within the EU but from outside the fiscal territory of the EU in the same way as for parcels ordered from outside the EU in the following situations:

- You order a parcel from within the EU territory, but outside the EU fiscal territory. The parcel is sent to you from outside the EU.

- You order a parcel from within the EU territory, but from outside the EU fiscal territory. The goods were manufactured outside the EU and the seller has not declared the goods for entry to the EU.

For example, the Åland Islands and the Canary Islands belong to the territory of the EU but not to its fiscal territory. Check if country from where your goods are dispatched is within such a region.