History of Finnish Customs: Free trade and economic integration

In the late 1940s, Finland joined the international General Agreement on Tariffs and Trade (GATT). Under the GATT arrangement, customs benefits obtained by a party to the agreement concerned other signatory countries as well. Nowadays, the GATT legacy is maintained by the World Trade Organization (WTO) which provides a framework for countries to negotiate reductions and removals of customs payments.

Finland became an EFTA associate member in the early 1960s. At the same time, the Soviet Union received corresponding customs benefits. The EEC free trade agreement was established in the early 1970s. Alongside the EEC agreement, Finland entered into agreements with socialist countries. Moreover, a customs benefits arrangement for developing countries was established. From the viewpoint of Finnish Customs, this required supervision of the origin of goods.

Reductions of customs duties were subject to long transition periods. It was not until the mid-1980s that a considerable part of Finland’s foreign trade was entirely exempt from customs duties. Establishing the origin of goods remained an important aspect of customs activity.

Swift development in transport solutions was also an essential element of integration. When car ferries started operating in the Baltic Sea in the 1960s, Finland’s foreign traffic processes underwent a major upheaval. Ships no longer stayed in harbours for weeks on end waiting for their cargos. The fact that container traffic became increasingly common since the 1970s meant that less labour was required. However, the acceleration of trade did not, naturally, eradicate the need for customs enforcement. To an increasing extent, customs controls in harbours focused on vehicle traffic.

Already in the 1960s, many thought that a customs authority was no longer needed, as the belief was that customs duties would no longer be levied in the future. Like in many other countries, also customs authorities in Finland took on many new tasks relating to import goods. The conditional exemption of free trade from customs duties required firm controls and supervision. Furthermore, Customs took on many other tasks concerning import goods, such as consumer protection. At the same time, the quantity of import goods increased dramatically.

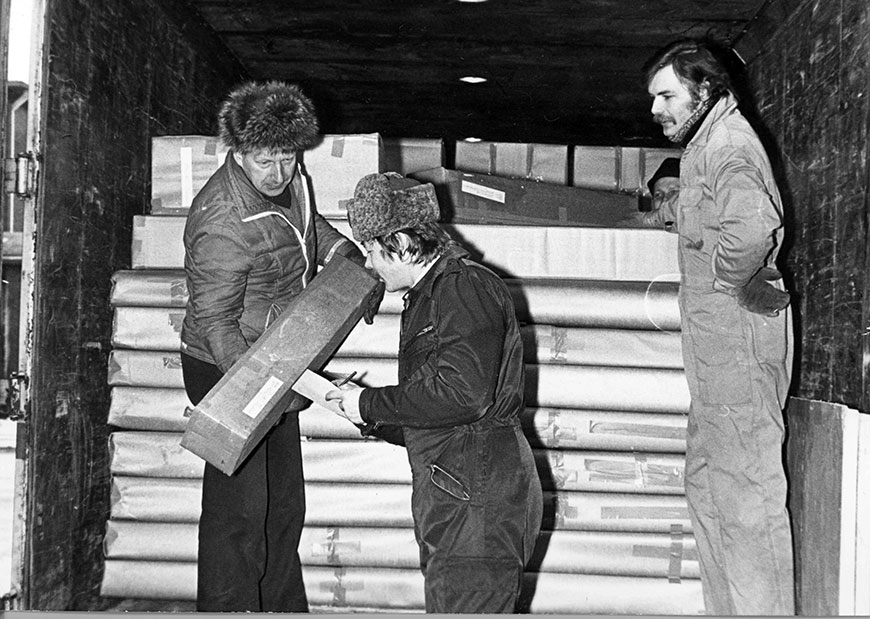

Image: In the early 1970s, customs clearance underwent a reform and was based on customs declaration procedures. Customs no longer examined all import goods in connection with customs clearance, but instead received customs declarations. In the 1970s, Customs introduced the first electronic customs clearance systems. From then on, Customs transferred information from paper forms into its own data system.