We enable our lawfully operating customers to conduct legal foreign trade smoothly. By developing our services, we promote equal opportunities for companies and citizens to interact with us. Our easy-to-use digital services promote tax compliance, reduce the carbon footprint from our customers’ movements and streamline our services by enabling customers to interact with us independently. We engage in regular and close cooperation through various networks and customer cooperation groups in different fields, among other things. We offer information about our services and any changes in our operations as well as instruct people on what to do through proactive advice. This saves time and money and avoids follow-up work.

We handle customs clearance and control duties without unnecessarily hampering the flow of goods. Enabling the efficient flow of lawful foreign trade and ensuring compliance with regulations are increasingly important for the competitiveness of Finland and the EU. We grant authorisations to companies to allow for more efficient customs processes. They contribute to the security of supply chains through their activities. Our control supports fair competition for companies and the accuracy of customs clearance while also uncovering tax fraud. We focus our efforts on risk actors and countering threats. We collect customs duties payable to the EU as well as taxes and other fees payable to the State in the correct amounts.

We compile official statistics on Finland’s international trade through an efficient and automated digital process to be used as the basis for information-driven decision-making. We simultaneously ensure appropriate and secure data processing and the reliability of data. We are committed to compliance with international ethical standards in all aspects of foreign trade statistics.

Our sustainability efforts

The reform of the customs legislation of the European Union and the development of customs clearance systems has been a major undertaking for the customs authorities in the EU from 2018 to 2025. The aim has been to facilitate customs processes and provide all customs declaration services electronically. The reform has harmonised customs declarations throughout the Union and standardised the content and structure of declarations and applications submitted to customs authorities.

The aim in specifying and implementing the new national customs clearance system has been to modernise the system to meet today's requirements. We already mapped the wishes and needs of Customs users and customers extensively during the requirements specification phase. The aim of the development work has been to enable automatic processing of declarations and analysis of declaration data. This speeds up the processing of declarations and decision-making and enables real-time responses during goods inspections. When previously it was necessary to maintain several customs clearance systems, now only one system is used. In addition, Customs’ e-services are available to customers 24 hours a day, every day.

Other services have also been streamlined

In connection with the customs clearance system development project, Customs has revamped its message exchange services for various procedures. Many online services have also been updated, such as the customs clearance for businesses, the import declaration service for private persons and the commodity code service Fintaric. The harmonisation of declarations for different procedures and the processing of customs declarations in a single system have made customs processes smoother and simpler. In 2024, export declarations were reformed as a part of the new Customs Clearance Service. The reform also required improvements to customer service and extensive training for advisers on the new legislation and declarations.

Digital authorisations support foreign trade operators

Customers can apply for most of the authorisations that fall within the competence of Customs and receive the authorisation decision electronically as soon as it is ready. With the digitisation of authorisations, applying for authorisations, making decisions and managing changes throughout the life cycle of the authorisation have become more customer-oriented and location-independent. Authorisation holders can manage some of the information related to authorisations themselves in the Authorisations and Decisions Service. Operations have become more efficient, and the benefits are also visible internationally in matters such as authorisations that are valid in more than one Member State and, above all, AEO authorisations.

AEO (Authorised Economic Operator) is a global partnership programme between customs authorities and economic operators. Its goal is to promote the safety and security of international supply chains. A company that has received an AEO authorisation is a trusted operator whose operating models in risk identification and internal control, among other things, meet EU requirements. Both Customs and the AEO monitor compliance with the requirements.

In return, AEOs are entitled to various facilitations within the EU, such as fewer traditional customs controls. In addition, many of the EU's most important trading partners recognise AEO authorisations and grant AEOs benefits equivalent to those granted to their national operators.

Read more

Finnish Customs uses automated decision-making in the processing of customs matters. In automated decision-making, a decision on a matter is made through automated data processing without being checked or approved by a human.

The new legislation on automated decision-making has made the use of automation more transparent and easier to understand for customers. The new legislation entered into force on 1 May 2023, and the transition period ended on 31 October 2024.

The law ensured that customers can find out how automated decision-making was used in a decision that affects them specifically. The Customs website explains how automated decision-making is used by Customs. The website contains implementation decisions concerning the automated decision-making procedures used by Customs. These implementation decisions allow customers to verify that Customs has fulfilled all the prerequisites for automated procedures and that they comply with the law.

Transparent documentation strengthens the legal protection of customers and enables the continued use of automated decision-making at Customs.

There can be no high-quality, smooth and fast customer service without automated decision-making

The use of automation in processing customs matters is essential due to the large volume of customs declarations. Automation also contributes to smoother and faster customer service at Customs. In 2024, nearly 8.9 million customs declarations for imports and exports were submitted to Customs. Of these, 98.6% were resolved using automated decision-making. A total of 35,837 amendment decisions on imports were made in 2024. Some of the amendments were initiated by the authorities and some by customers. In 9,077 cases, the amendment decision could be confirmed automatically. The number of decisions and the proportion of automated decisions are constantly increasing.

As a security authority, the information we provide must be easy to understand and up to date. In 2024, we focused particularly on improving customer instructions as well as communication regarding customs clearance and restrictions.

We launched the new website of Finnish Customs in the spring of 2024. The new website has been designed with a particular focus on making the instructions as easy as possible for customers to understand. We also improved communication regarding restrictions on travellers, i.e., what travellers are and are not allowed to bring into the country. We updated all customs offices with simple animations and illustrations to remind travellers of the restrictions and thus ensure that Finland remains safe. In addition, we communicated about customs clearance and restrictions through social media campaigns.

The website serves customers better than ever before

The website redesign was an extensive project, during which we clarified hundreds of customer instructions, made the instructions easier to find and redesigned the layout of the pages to make them more user-friendly. In addition, we tested the functionality of the site with customers prior to publication.

Customers have been satisfied with the revamped website. While customer satisfaction on the old site was 7.7/10, on the new site it is 8.5/10 or even higher on the most popular pages. We will monitor customer satisfaction and continue to develop the website even after the redesign.

Feedback from customers helps us at Finnish Customs to develop customs processes and our own operations to make them smoother and better suited to our customers' needs.

We actively and continuously collect feedback from our customers. We offer a variety of ways to provide feedback as easily as possible or respond to customer surveys right when the customers’ experiences are still fresh in their minds. We also use shared government tools, such as the Suomi.fi quality tool, which has a public page where anyone can view the ratings we have received.

The feedback provided is valuable

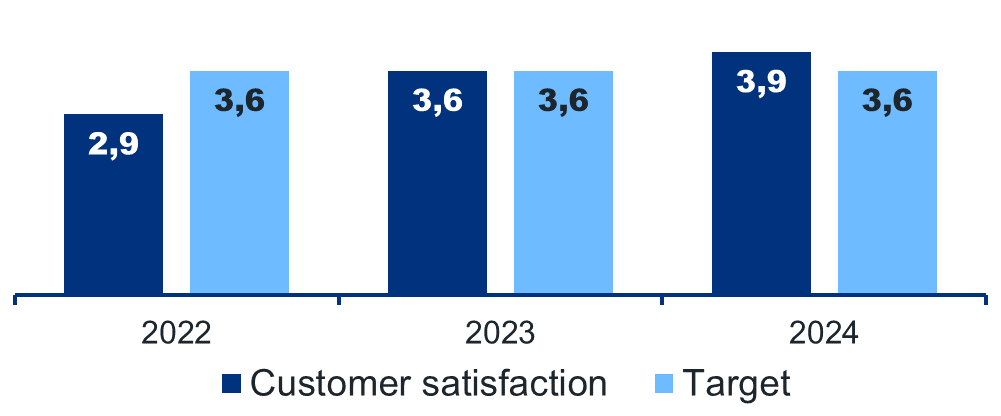

We receive the most feedback from customer surveys conducted after service interactions. In terms of quantity, we received the most feedback in 2024 from individual customers regarding import declarations. We received a lot of praise for the ease of use of the service, which is also reflected in the average customer survey rating of 3.9 (on a scale of 1–5). The search for goods by name in the customs clearance service helps those submitting the declaration select a commodity code for the most common goods. For this reason, we regularly add the most commonly requested items to our search results. However, due to the complexity of classification legislation, we are unable to add all requested items.

In general, disruptions were the most common source of feedback from individual and business customers, whether these involved Customs' systems or declarations for which transport operators were responsible. We prioritise solving problems and communicating about them; fortunately, such situations are becoming increasingly rare.

In addition, we sent a separate survey to our largest business customers in customs clearance to find out how satisfied they were and to ask for suggestions for improvement. Customer feedback confirmed previously identified areas for improvement, based on which we improved the transit declaration process in the new Customs Clearance Service. At the same time, the survey helped identify challenges related to export declarations for the next development cycle.

We received most of the feedback on temporary shortcomings in the website redesign via the reaction buttons on the website. However, they also provided us with positive feedback on the new website and useful tips on how to clarify customer journeys in situations in which customers could not find the information they were looking for.

Our feedback team forwards all verbal feedback to the service owners. Three times a year, service owners report in a joint summary on how the service or activity has been developed based on feedback. Development measures based on feedback have often already been included in service owners' plans, but customer feedback helps to prioritise measures and assess their urgency. A summary of the feedback provides all Customs personnel with an overview of how Customs' services and operations are perceived by customers.

Customer advice figures

Customer bulletins

97 pcsCustomer guides

271 pcsCompany-specific advice

Questions answered by email

Phone calls for customs advice and support in making customs declarations

Chats

Following the experiment with clear pictures in the spring of 2023, we decided to start developing the customer experience of special groups to ensure that the fundamental rights of different customers are realised and to facilitate the journey of travellers.

We invited a large group of lobbyists and representatives of non-governmental organisations to co-create the customer journey of travellers at Helsinki Airport. Based on our walking tours of the airport, we identified specific needs of our customers, which we then set out to resolve together with representatives of the customer groups. We paid particular attention to the needs of the visually and hearing impaired, elderly people, wheelchair users and children.

Based on our observations, we made adjustments and improvements to streamline their service interactions. We ensured that the improvements worked by testing them together with stakeholders and experts by experience.

A student at the Institute of Design and Fine Arts of the LAB University of Applied Sciences did a final project on the experiment: Improving the Customer Experience at Airport Customs for the Visually and Hearing Impaired: Service Design as a Tool.

The experiment won the Kaiku award in 2024 (article in Finnish), and an article about the groundbreaking experiment was also published in the magazine of WCO. The results of the experiment have been presented to stakeholders, the parties granting the Kaiku award and the developers of the joint service points of the Ministry of Finance. In addition, a request was made to use the experiment with clear pictures as a case study in the eOppiva course "Asiakaslähtöisen toiminnan perusteet valtionhallinnossa” (in Finnish) on the basics of customer-oriented approach in central government.

The best practices from the experiment have been compiled and presented to the premises and materials administration. The aim is to implement the best practices at Finnish Customs’ other customer service points as far as possible.

Read more

Finnish Customs Sustainability Report 2024: The focus of premises development was on accessibility and special groups

Finnish Customs Sustainability Report 2023: More accessible customs clearance – images to support communication

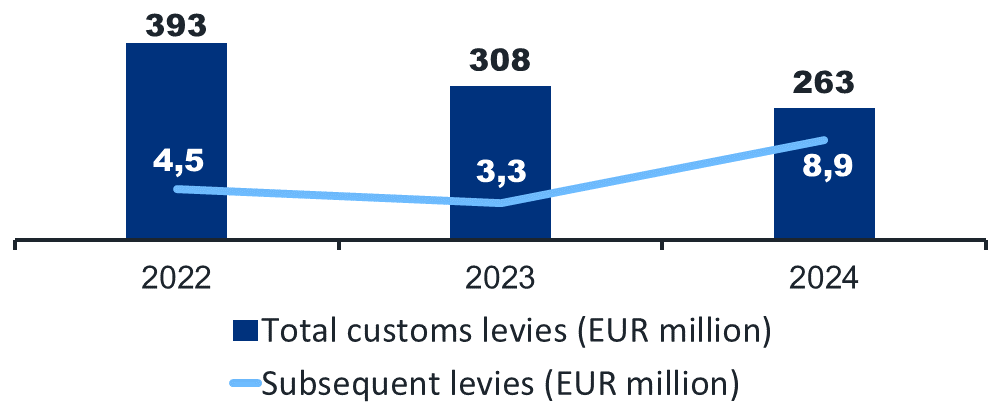

The amount of taxes and fees collected by Finnish Customs in 2024 was EUR 263.2 million, which is 14.9% less than in the previous year. There has been a decline in both the amount of customs duties payable to the EU and the amount of taxes and fees payable directly to the State. The share of tax arrears out of the taxes imposed last year was 0.32% in customs taxation – well below the target level of one per cent.

Follow-up inspections

Follow-up inspctions after customs clearance ensure the accuracy of customs clearance while promoting and ensuring smooth foreign trade and equal competitive conditions for operators. Approximately EUR 8.9 million of additional customs duties and taxes were levied as a result of measures proposed on the basis of inspections. Without these measures, companies would have gained an unfair competitive advantage, the EU would have lost internal assets and the Finnish government would have missed out on taxrevenue.

Inspections with a focus on anti-dumping duties

If imports from countries outside the EU may cause injury or a risk of injury to EU industry, anti-dumping and countervailing duties can be levied on the goods in addition to general customs duties. Anti-dumping duties were the focus of several inspections during the year. The items inspected included bicycles and electric bicycles of Chinese origin.

The inspections revealed errors in the declaration of the value and country of origin of the bicycles, for example. Bicycles are imported to Finland either fully assembled or in parts, in which case they are assembled in Finland. The bicycles may also have been assembled in China or another country, and the parts used may originate from different countries. Determining the country of origin in such cases can be very complicated.

Investigating tax fraud in cooperation with the European Public Prosecutor’s Office

Finnish Customs’ Economic Crime Investigation Unit cooperates with the European Public Prosecutor's Office (EPPO) in preliminary investigations related to additional and anti-dumping duties, among other things. An extensive chain of value-added tax fraud in the internal market is currently under investigation. The case is the first value-added tax fraud investigation conducted in cooperation with the EPPO. Close cooperation has enabled prompt international cooperation and the exchange of information to promote the preliminary investigation. The preliminary investigation has involved cooperation between approximately ten countries.

A typical example of a VAT fraud investigated by the EPPO is a carousel fraud or chain tax fraud. Carousel fraud involves circulating goods or creating a fictitious invoicing chain between at least two EU countries. These fabricated transactions are used to obtain unjustified value-added tax rebates. Cover companies are used to apply to the Tax Administration for rebates of value-added tax that has never been paid. According to the Tax Administration's estimate, Finland loses approximately EUR 30 million annually to such VAT fraud.

Read more

Finnish Customs Enforcement 2024: Investigating value-added tax fraud in partnership with the European Public Prosecutor's Office

The number of import declarations for low-value goods ordered from online stores outside the EU has grown rapidly. In 2024, the number of declarations was eight times the number in 2023. In figures, this meant over 28 million consignments in approximately 9 million e-commerce shipments ordered and sent to Finland. One e-commerce shipment may contain multiple consignments, and one consignment may contain one or more copies of the same item, such as T-shirts.

Last year, shipments ordered from China accounted for 97.7% of the total number of these customs declarations. The number was nine times as many as in the previous year. The most popular items ordered were textiles of different kinds (press release in Finnish) – every fourth item ordered was a textile or textile product. The next most popular items included plastic and rubber products, footwear, headgear, base metals as well as machinery and equipment. The average value of a low-value consignment was EUR 6.02 when imported from China, EUR 28.33 from the United Kingdom and EUR 43.05 from the United States.

Consumer habits of private individuals are changing

Individual customers prefer these low-value shipments of EUR 150 at maximum when ordering goods from outside the EU. If the value of the shipment including transport costs does not exceed EUR 150, no customs duty is payable. However, value-added tax must generally be paid for all shipments from outside the EU.

Despite the large number of e-commerce shipments, their value only accounts for about 1% of Finland's total imports from outside the EU. The nature of shipments has also changed. In the past, most shipments from third countries were addressed to businesses. In 2024, the vast majority — more than 90% — of shipments went to private individuals.

E-commerce puts pressure on systems and eats into EU revenue

The rapid growth of e-commerce is also reflected in the load on the system. The information systems of the authorities are mainly designed to handle commercial declarations and a reasonable number of declarations by private individuals. In order to cope with the flood of declarations, Finnish Customs has been forced to increase the capacity of its systems in recent years, which is expensive.

The EU economy is also affected by the strong growth of e-commerce. Shipments worth EUR 150 or less are subject to value-added tax but not customs duties, which means that the EU is losing out on significant revenue. Counterfeit products undermine trade in genuine products. In addition, organised crime is involved in the trade in these products as well as products that are subject to restrictions and prohibitions.The duty-free treatment of low-value e-commerce shipments is likely to be phased out in the coming years.

Read more

Finnish Customs Sustainability Report 2024: Finnish Customs cannot guarantee the security of online purchases from outside the EU – buyers beware

Finnish Customs Sustainability Report 2024: We are exposed to chemicals in everyday items

Finnish Customs Enforcement 2024: Low-value e-commerce shipments from outside the EU pose various challenges for Finnish Customs

Indicators

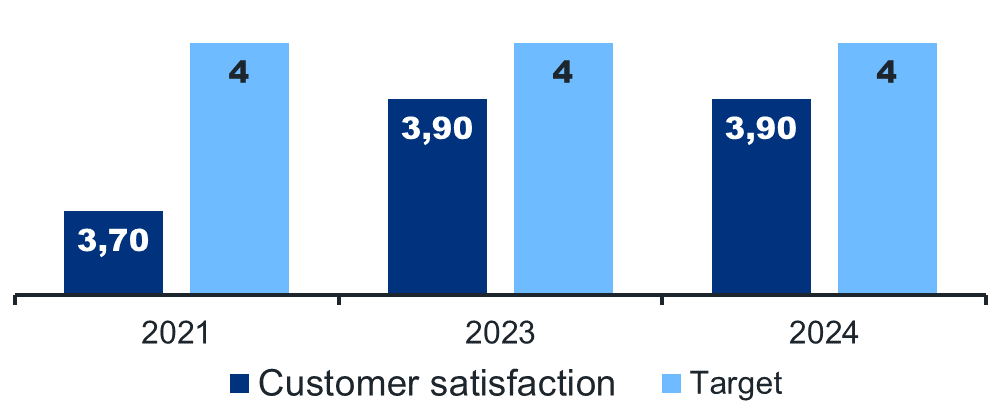

Customer satisfaction in customs clearance procedures, business customers (scale: 1–5)

Customer satisfaction, individual customers (scale: 1–5)

Total customs levies and subsequent levies following company and document audits (EUR million)