The volume of e-commerce from non-EU countries was lower than expected last year – the IOSS made it easier to pay the import VAT

The removal of the VAT exemption in summer 2021 for low value parcels sent from outside the EU affected a large number of online shoppers. Since 1 July 2021, all purchases delivered from outside the EU have been subject to VAT and customs clearance. The joint EU VAT reform took effect at the same time in the entire EU. A particular objective of the reform was to ensure fair competition conditions for businesses established in the EU and non-EU operators as well as to generate tax revenue for the state.

Before the reform, customs clearance and VAT obligations mainly applied to parcels arriving from outside the EU that were worth more than 22 euros. As for imports worth no more than 150 euros, customers have two alternatives for paying the VAT. The VAT is paid either at the time of purchase to the IOSS registered seller or in conjunction with the customs clearance.

– This was a big change for online shoppers, because a large number of online purchases are worth less than 22 euros. The Import-One-Stop-Shop (IOSS) made the process easier for them. When the seller is registered for the IOSS, the VAT can be paid to the seller at the time of purchase for consignments worth no more than 150 euros. Online stores will then pay the VAT directly to the EU, says Senior Customs Officer Nadja Painokallio.

Transport companies usually declare these purchases on behalf of the customers, and the consignments will be delivered directly to the recipients (consignees). However, the import duties and taxes on goods subject to excise duty must be paid in conjunction with the customs clearance.

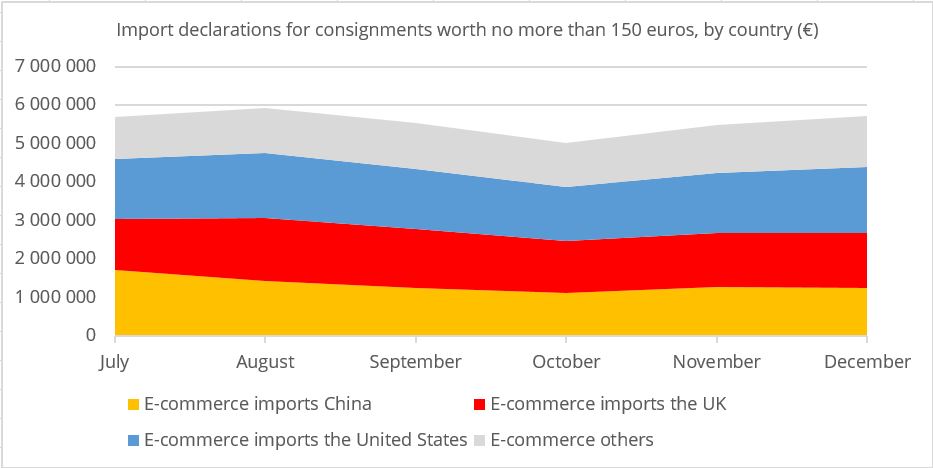

Finnish Customs collected VAT on 45 per cent of the declarations. Regarding e-commerce declarations in July–December 2021, Finnish Customs collected altogether 4.7 million euros in VAT to Finland. As for the rest of the e-commerce import declarations, the VAT was collected by the Finnish Tax Administration via the IOSS.

Customers still needed personal advice and guidance

We kept producing up-to-date information e.g. for our website and for the Customs duty calculator as well as answers to customers’ questions. We also took customer feedback into account when developing the Import Declaration Service for private persons to make the declaration process as smooth and easy as possible. The need for information services for both business and private customers increased considerably after the VAT reform.

– We also recruited people from within Finnish Customs to the Customs Information Service to address the situation. The demand for advice and guidance was at its greatest in the first few months after the VAT reform, when the number of contacts to the Customs Information Service temporarily tripled, says Nadja Painokallio.

The customs clearance volumes increased again in December

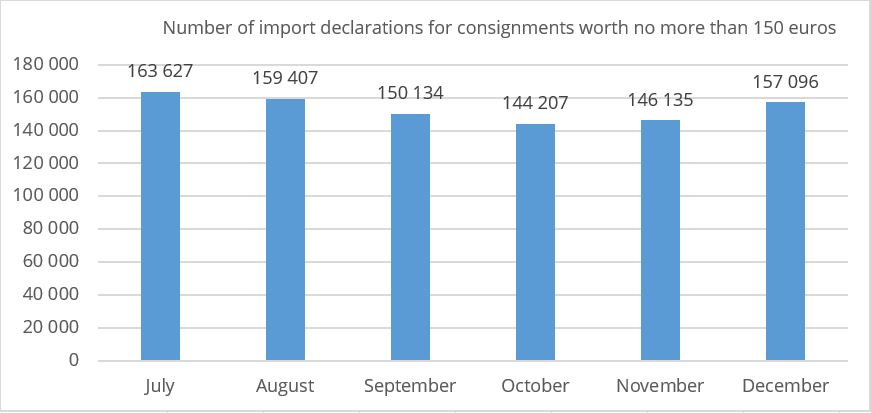

From 1 July to 31 December 2021, more than 900 000 new import declarations were submitted for consignments worth no more than 150 euros arriving in Finland. The number of declarations decreased from the figures for the beginning of July towards the autumn, but increased again in December. Private individuals submitted approximately 92 per cent of the declarations, the rest of the declarations were submitted by businesses.

– The statistical value of import declarations for consignments worth no more than 150 euros has only been over five million euros per month, whereas in 2021, the monthly level of our imports from outside the EU was 2 040–3 015 million euros, says Director of Statistics Olli-Pekka Penttilä.

Regarding e-commerce, the biggest import country outside the EU was the United States (28 per cent), followed by the UK (26 per cent) and China (24 per cent). The imports from other countries amounted to 21.5 per cent.

– The volume of e-commerce from non-EU countries was lower than expected for several reasons. The most important reason was the reduction in air traffic due to the COVID-19 pandemic. The number of flights is still considerably lower than before the pandemic, and that is why the volume of air freight is also still low, says Penttilä.

– Our aim is to promote, together with other operators, international e-commerce and fair competition conditions for businesses, emphasises Penttilä.