Declarations for arriving goods

Safety and security data must be provided with entry declarations to Customs for all goods that arrive in (are imported into) the territory of the EU Various details of the traders, goods, transports and routes are provided in these declarations. The time limits for submitting declarations depend on the mode of transport and transport routes.

Who is responsible for submitting the declarations?

The carrier is responsible for submitting the declarations even if it appoints a representative.

In the case of postal consignments, it is the postal operator in the country of destination who is responsible for the entry declarations. However, the carrier submits a declaration for the receptacles of postal items it carries.

The submitter of the entry declaration must notify the party responsible for customs clearance of the declaration MRN, the house level transport document number and the goods item number, so that the goods can be cleared.

If you can’t submit declarations due to a service disruption in the system, follow the instructions for the fallback procedure.

Declarations and notifications for goods arriving from outside the EU

Air transport

- entry summary declaration (ENS) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

- arrival notification (AN) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

- presentation notification (FI332) via message exchange or in the Customs Clearance Service.

Sea transport

- entry summary declaration (ENS) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

- arrival notification (AN) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

- presentation notification (FI332) via message exchange or in the Customs Clearance Service.

Rail transport

- entry summary declaration (ENS) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

- presentation notification (FI332) via message exchange or in the Customs Clearance Service.

Road transport

- entry summary declaration (ENS) via message exchange or in the ICS2 Declaration Service for Safety and Security Data (STI-STP).

An entry summary declaration for road transport (F50) is submitted for goods carried on a road vehicle arriving on board a vessel.

In the entry summary declaration, provide the active border transport means as follows:

- mode of transport: 3 – Road transport

- type of identification: 10 – IMO ship identification number”

- IMO ship identification number

- type of means of transport: e.g. 150 – General cargo vessel.

Provide the details of the road vehicle in the details of the passive means of transport.

No entry summary declaration is submitted for these goods, but a temporary storage declaration. In addition, a presentation notification is submitted.

Subscribe to receive ICS2 unavailability and BCP notifications by email from the EU, if you submit entry summary declarations (ENS) for air or sea transport in the ICS2 Declaration Service for Safety and Security Data (STI-STP) or via message exchange. You can subscribe to these notifications in ICS2 STI-STP. You need the Suomi.fi mandate “Customs clearance” for logging in to the service.

You can find the guidance on subscribing to the notifications on CIRCABC, in the public group ”EU Advance Cargo Information System (ICS2)”, in the folder ”ICS2 Business Continuity”. The guidance is titled “How to receive BCP notifications”.

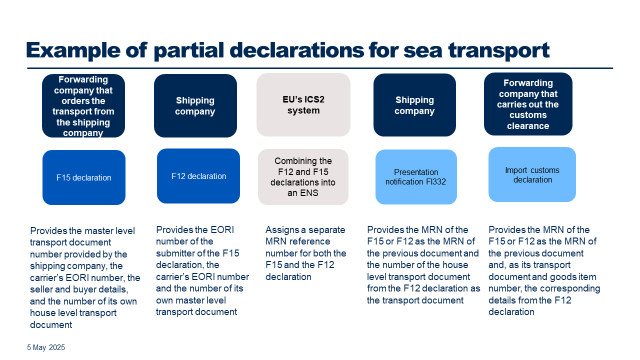

If the operator that ordered the sea or air transport (house filer) does not want to send data such as the seller and buyer details to the carrier, the carrier and the house filer can agree to submit their own separate entry summary declarations. This means that the carrier submits a master level entry summary declaration and the house filer a house level entry summary declaration.

Forward the necessary details to the other operators

The carrier submits its own declaration with the master level transport document details. The house filer submits its own declaration with the house level consignment note and consignee details.

The seller and buyer details, detailed goods item data and the number of the house level transport document are details that are only shown in the house filer’s declaration.

The operators must make sure that they share the necessary details with each other.

- The carrier must notify the house filer of the master level transport document number.

- The house filer must forward the house level transport document number and goods item numbers used in its own entry summary declaration to the party responsible for the customs clearance.

- The house filer must make sure that the carrier is also notified of the house level transport document number, even though the carrier does not provide this detail in its own declaration.

Provide the details linking the partial declarations together

The carrier must indicate in its own declaration using an EORI number which house filer(s) provide(s) their own declaration(s). The house filer, in turn, must provide the EORI number of the carrier and the number of the carrier’s master level consignment note.

Based on these details, the information in the declarations is linked together in the EU’s ICS2 system. Thus, two partial declarations together form an entry summary declaration containing all the details required by Customs.

Possible combinations of entry summary declarations

For transports by air, the airline submits an entry summary declaration of type F21 and the house filer an entry summary declaration of either type F22 or type F26.

For transports by sea, the shipping company submits an entry summary declaration of type F13 and the the house filer an entry summary declaration of type F17, if a straight bill of lading has been drawn up for the goods. In other cases, the shipping company submits an entry summary declaration of type F12 and the house filer an entry summary declaration of type F15.

Exception: in sea transports, it is possible that, instead of an entry summary declaration of type F15, two house filers submit the data using separate declarations.

- One house filer submits a declaration of type F14 that contains the details of the house consignment transport document (e.g. number of the house level transport document, goods item details).

- The other house filer submits an entry summary declaration of type F16 that contains the goods consignment details indicated in the commercial contract (seller, buyer).

When is an entry summary declaration not required?

An entry summary declaration is not required for goods carried through the territorial waters or the airspace of the customs territory of the EU without stopping in the territory of the EU. In addition, this declaration is not required for certain goods:

- electrical energy

- goods entering by pipeline

- items of correspondence

- household effects that are duty-free on the basis of the Duty Relief Regulation provided that they are not carried under a transport contract

- goods for which an oral customs declaration is permitted upon import, provided that they are not carried under a transport contract (e.g. non-commercial goods)

goods for which an oral declaration is permitted upon temporary admission, provided that they are not carried under a transport contract (for example pallets, containers and means of transport) - goods contained in travellers’ personal baggage

- goods imported under cover of a NATO form 302

- weapons and military equipment brought into the customs territory of the Union by the authorities in charge of the military defence of a Member State, in military transport or for the sole use of the military authorities

- certain goods brought from offshore installations by a person established in the Union (such as returned provisions and goods which were used to fit or equip the offshore installations)

- Diplomatic goods covered by the Vienna Convention of 1963

- goods on board vessels and aircraft which have been supplied for incorporation as parts of or accessories in those vessels and aircraft, for operation or to be consumed or sold on board

- goods brought into the customs territory of the Union from regions outside the customs territory of the Union (e.g. Ceuta and Melilla, Gibraltar, Heligoland, the Republic of San Marino and the Vatican City State)

- goods covered by ATA or CPD carnets, provided they are not carried under a transport contract.

If a carrier brings in or takes out empty means of transport (such as containers, trailers, wagons and pallets) or empty packages across the EU border which are not its own and for which a transport contract has been drawn up, an entry or exit summary declaration must be provided for them.

The declaration is only submitted for packages that are reusable and have permanent markings. There is no requirement to submit an exit summary declaration for empty packages.

Empty means of transport or packages carried on vessels or aircraft that arrive directly in Finland from an EU port or airport, or from Norway or Switzerland, need not be declared using a temporary storage declaration.

An entry or exit summary declaration must be submitted within the time limit specified for each mode of transport.

- When an empty means of transport arrives in the EU, the carrier or its representative presents the MRN of the entry summary declaration.

- When goods are carried by road, it is recommended that the MRN and the container number be presented at the customs office of entry in the form of an entry in the transport permit or in another document carried with the transport.

- When carrying goods by sea and rail, a presentation notification is to be used.

Containers that have been rented for the company’s own use are regarded as the company’s means of transport and safety and security data need not be submitted for them with an entry or exit summary declaration.

Declaration details in entry or exit summary declarations in road and rail transport

In road and rail transport, provide both the commodity code and a verbal description for an empty container or package. The text ‘EMPTY CONTAINER’ should be entered as the verbal description. In road transport, the container number must also be provided. In rail transport, the description should be provided as ‘EMPTY WAGON’ and, for a package, as ‘EMPTY PACKAGE’.

The code NE (unpacked) can be entered as the ‘kind of packages’, in which case the number of means of transport (e.g. containers) is entered as the number of pieces. The ‘container identification number’ must be provided, even if the container number has been entered under the goods description. The mass provided for an empty container or other means of transport is the unladen mass of the container or other means of transport. Customs’ system will reject any declarations where the gross mass is provided as 0 (zero).

If an empty container or other means of transport carried under a transport contract is returned without providing a separate consignment note concerning the return, the consignment note drawn up for the purpose of exporting the goods is provided as the transport document, which contains an entry on returning the empty container.

As the consignor of the empty container that is to be returned, enter the operator who has received the cargo that was transported in the container. The container storage operator at the port can be entered as the consignee. The holder of the empty container who has requested its return can also be entered as the consignor and consignee.

Declaring empty means of transport in sea transport with an entry summary declaration

When you submit an entry summary declaration for an empty container that is not the shipping company’s own, provide the container details at goods item level as follows:

- container packed status: A – empty

- container identification number (e.g. ABCD1234567)

- container size and type

- container supplier type (Shipper supplied)

- Harmonised System sub-heading code 860900

- description of goods: empty sea container

- the gross mass: the weight of the container

- type of packages: NE

Please note that you can only provide the container details if you have indicted in the details of containers for the house consignment that the goods (containers) are transported in containers.

Declaring empty means of transport in sea transport with an exit summary declaration

When you submit an exit summary declaration for an empty container that is not the shipping company’s own, provide the container details as follows:

- container identification number (e.g. ABCD1234567)

- container supplier type (Shipper supplied)

- container commodity code: 860900

- description of goods: empty sea container

- the gross mass: the weight of the container

- type of packages: NE.

In declarations, the goods description provided must be appropriately precise. The Commission’s guidance on acceptable and unacceptable terms for the description of goods

The declarant must store the documents related to the declaration they have submitted to Customs or the electronic data from which the declaration details were obtained. These documents to be stored include e.g. transport documents provided in (entry) summary declarations.

All documents may be stored electronically. The storage period is the current year plus three years. The response notifications sent by Customs don’t need to be archived, unless otherwise laid down or prescribed elsewhere.

Finnish Customs’ regulation on the archiving of documents when declarations are lodged electronically (9/2016) (not available in English).

- A temporary storage declaration is submitted for goods transported within the EU.

- Temporary storage declarations are not submitted for transports within Finland, e.g. when goods are transferred by sea from Vuosaari to Hanko. Undeclared goods must, however, be placed under transit.

- Goods that arrive carried by a shipping service

- For Union goods carried by a regular shipping service approved by Customs, no temporary storage declarations or presentation notifications are submitted, and non-Union goods shall be transported under the T1 transit procedure.

- A temporary storage declaration shall be submitted for all goods to be unloaded from a non-regular shipping service vessel. If proof of Union status has been obtained for Union goods from the Commission’s Proof of Union Status system (PoUS), a temporary storage declaration is not required for them.

EU guidance and recordings

The group “EU Advance Cargo Information System (ICS2)” on the CIRCABC website:

- Recording (2 July 2025) on how to use the ICS2 STI-STP portal and how to fill in the ENS. Download the recording from the folder “ICS2 Training Material”.

- Presentation on road and rail traffic. Download the presentation from the folder “ICS2 Training Material”.

- General EU guidance on the ENS. Download the guidance from the folder “ICS2 Common Operational Guidance”.

- Attend the EU Commission’s monthly remote meetings called “ICS2 Technical Operational Calls”. Attendance does not require registration. The date of the meeting is published about one month in advance in the Commission’s ICS2 event calendar. You can find the meeting link in the event calendar under “Agenda”.

Also, follow the EU’s ICS2 info page, where you can find resources such as

- “Latest news” (information on updates to the materials on the page)

- ”eLearning courses” (self-study courses covering different modes of transport).