Ordering alcohol online

How you declare alcohol depends on its region of origin. You may have to pay taxes and customs duties for alcohol.

Is the country you are arriving from an EU country? Look it up here.

Ordering alcohol from inside the EU

As a rule, you do not have to declare alcoholic beverages. However, it is possible that you are required to pay tax for the alcohol you order.

Check the Tax Administration website for instructions.

Please note that there are changes concerning the ordering of alcohol as of 1 September 2024. Read more in our news bulletin (in Finnish and Swedish).

For example, the Åland Islands and the Canary Islands belong to the customs territory of the EU but not to its fiscal territory. Alcoholic beverages arriving from such areas must be declared. They are subject to value added tax and excise duty, but not customs duty.

Read more about how you can declare your consignment. You can also request a transport operator or a forwarding agency to declare alcoholic beverages for you.

First, check if the area is part of the fiscal territory of the EU.

Ordering alcohol from outside the EU

If you order alcohol from outside the EU, you are required to declare it. You are required to pay VAT and excise duty on the alcohol, as well as possible customs duties.

Read more about how you can declare your consignment. You can also request a transport operator or a forwarding agency to declare alcoholic beverages for you.

If you are ordering alcohol from outside the EU, you are required to pay tax and possibly customs duty.

The amount of tax depends on the beverage in question, among other things. Take a look at the examples provided below (for guidance only).

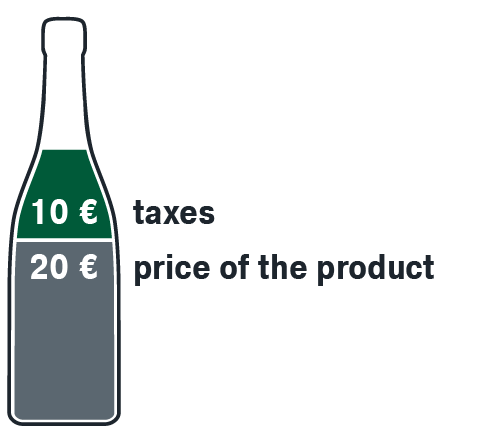

Example 1: Red wine

You buy a bottle of red wine with capacity of 0.75 litres. The alcohol strength of the wine is 13.5% by volume.

If the bottle of red wine costs 20 euros and there are no transport costs for the product, the total amount of import duties and taxes you must pay in addition is 10.47 euros.

The total amount you will pay for the bottle of red wine is €20 + €10.47 = €30.47.

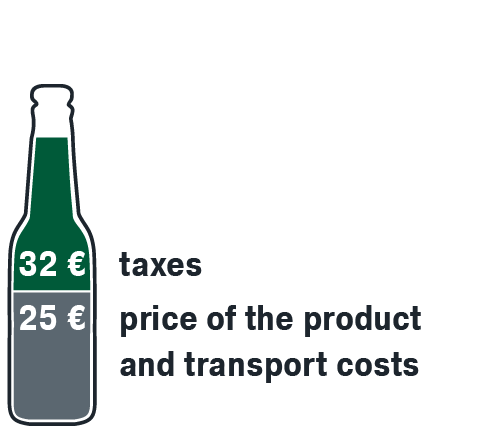

Example 2: Whisky

You buy a bottle of Scotch whisky with capacity of 0.70 litres. The alcohol content of the whisky is 40% by volume.

If the bottle of Scotch whisky costs 40 euros and the transport costs are 10 euros, the total amount of import duties and taxes you must pay in addition is 32.94 euros.

The total amount you will pay for the bottle of Scotch whisky is is €40 + €32.94 + €10 = €82.94.

Example 3: A case of beer

You buy a case of beer with capacity of 8 litres. The alcohol content of the beer is 5.5% by volume.

If the case of beer costs 15 euros and the transport costs are 10 euros, the total amount of import duties and taxes you must pay in addition is 31.75 euros.

The total amount you will pay for the case of beer is €15 + €31.75 + €10 = €56.75.