Changes to entry declarations and temporary storage declarations

The changes to the EU customs legislation will bring about phased changes to customs declarations in 2020‒2025.

Declarations for goods arriving from non-EU countries – now

The following must be submitted to Finnish Customs via the arrival and exit declaration service (AREX) or via message exchange:

- entry summary declaration in maritime, rail and road transport

- combined arrival and presentation notification in sea and rail traffic

Regarding transports with shared cargo space, the arrival notification and the presentation notification are usually submitted as separate notifications. The entry summary declaration and the presentation notification together are regarded as a summary declaration for temporary storage.

The details in a transit declaration submitted for goods arriving under the transit procedure are used as a summary declaration. The safety and security data can also be provided in the transit declaration, in which case no separate entry summary declaration is required.

For consignments arriving in air traffic, an entry summary declaration must be submitted in the ICS2 system for safety and security data. For them, a presentation notification must also be submitted to Customs via message exchange or in the Customs Clearance Service, when the consignment arrives in Finland.

Changes to declarations and notifications for goods arriving from non-EU countries

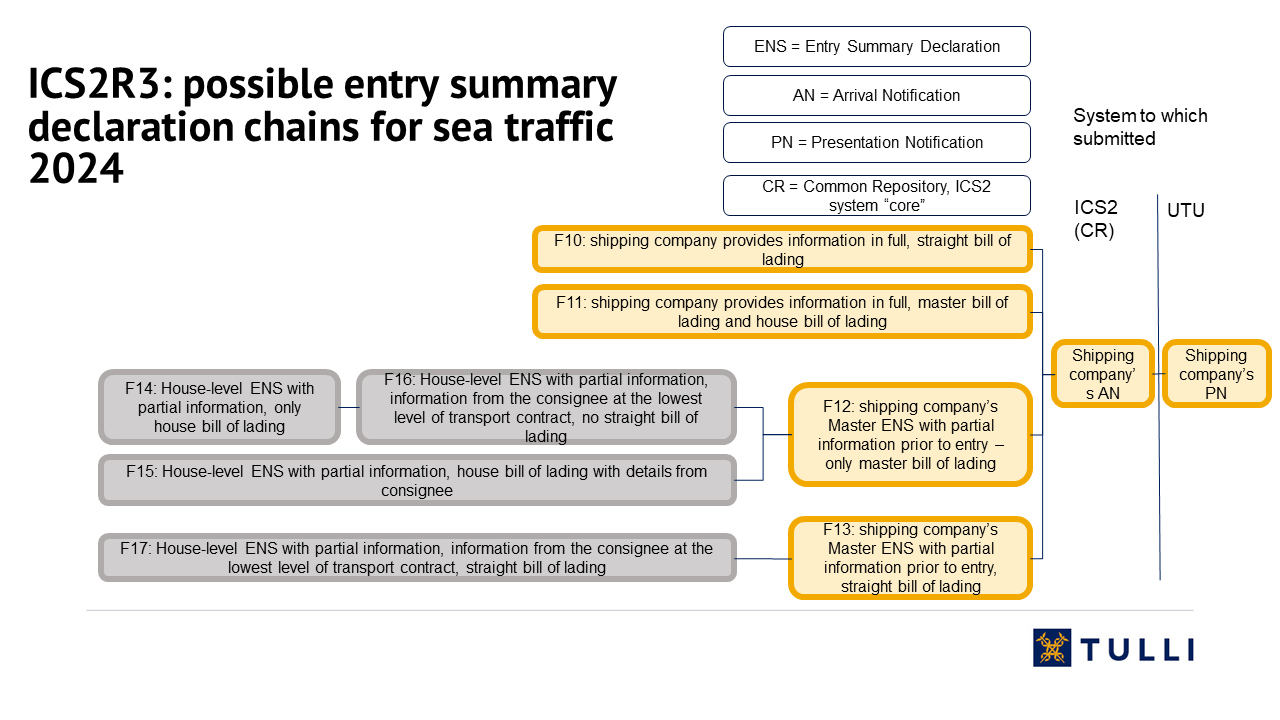

There will be changes to the entry summary declaration and, in the future, they will be submitted to the ICS2 system for safety and security data. The new declarations will be introduced for each mode of transport in several phases. The declarations for postal consignments were introduced in 2021; the declarations for air transport from 1 March 2023 and the declarations for the other modes of transport will be introduced in phases in 2024.

The arrival notification, which will be a new notification, is separate from the presentation notification. It will be submitted after the entry summary declaration to the ICS2 system for safety and security data, when the goods arrive by air, sea or rail. These notifications cannot be submitted to the Finnish Customs system.

The new declarations can be submitted either via the EU’s e-service or via message exchange. Message declarants must test the messages in the Commission’s testing service. If a message declarant uses an IT service provider for technical sending of messages, the IT service provider will test the message exchange.

In addition to the entry summary declaration and the arrival notification, a presentation notification for goods unloaded in Finland must be submitted to Finnish Customs via the Customs Clearance Service or via message exchange. This notification will be tested with Finnish Customs.

In Finland, there will still be no requirement to submit a separate temporary storage declaration for consignments arriving from outside the EU after the entry summary declaration and presentation notification have been lodged, if the first point of entry into the EU for the consignment is in Finland.

If the transport company doesn’t have access to all the details required for the entry summary declaration before loading, the consignor or the forwarding agency can provide the safety and security data required before loading by submitting an entry summary declaration with only partial details and the number of the transport company’s master air waybill (MAWB). In that case, the transport company submits its own entry summary declaration with partial details after loading, before the arrival of the goods.

Entry summary declarations can be submitted with partial details in air, sea and rail traffic.

In the new entry summary declaration, the mandatory safety and security data include details of the seller and the buyer as well as the goods description and the commodity code at the level of at least six digits.

More information: Diagrams of arrival declarations

ICS2 (Import Control System 2), phase 2 of the EU's safety and security reform involving entry declarations

ICS2 system, into which the entry declarations are submitted (previously referred to as CR)

STI-STP (Shared Trader Interface-Shared Trader Portal), the Commission’s ICS2 declaration service

CIRCABC website, contains message specifications published by the Commission

ITSP (Information Technology Service Provider), service provider for message declarants

IE (Information Exchange), used when exchanging declaration messages

DVV (Digital and Population Data Services Agency), server certificates

ICS2R2 (ICS Release 2), declarations for air cargo

ENS (Entry Summary Declaration)

AN (Arrival Notification), submitted to the Commission’s system

PN (Presentation Notification), submitted to Finnish Customs’ system

TSD (Temporary Storage Declaration), submitted by the carrier

AC (Assessment Complete), response received for an ICS2 declaration, notifying that the declaration has been accepted and the goods can be loaded onto the vessel or aircraft departing for the EU

EO (Economic Operator)

HTI (Harmonised Trader Interface)

KC3 (Third Country Known Consignor)

The EU Commission has published message specifications on the Circab website for the messages to be deployed. There will be new entry declaration messages, and the data content of the old messages will change.

Message abbreviations

The messages are numbered according to their use. Messages beginning with IE3F are entry summary declarations that message declarants send to the EU’s ICS2 system. The data contents of entry summary declarations vary depending on the mode of transport, on who submits the declaration and on whether a declaration with all details or only partial details is provided. For example, the messages IE3F10–IE3F17 are entry summary declarations for maritime cargo and the messages IE3F20–IE3F29 are entry summary declarations for air cargo.

The new message declarations are numbered as follows:

- Messages beginning with IE3A are amendment requests sent by message declarants.

- For example, amendment of the message IE3F20 details is requested using the message IE3A20.

- Messages beginning with IE3Q are used e.g. for requesting additional information from the declarant (IE3Q02) or the declarant can request invalidation of the declaration (IE3Q04).

- Messages beginning with IE3R are responses.

- IE3R01 is a response sent to inform the declarant of the registration of the entry summary declaration and of the MRN issued to the declaration.

- Messages beginning with IE3N are various notifications.

- IE3N06 is a notification sent by the message declarant of the arrival of the goods, i.e. an arrival notification.

- IE3N08 is a control notification sent to the customer.

Where to find the message specifications

Read about the ICS2 declarations’ message specifications and customer testing on EU’s Circabc webpage in group ”EU Advance Cargo Information System (ICS2)”.

The message data requirements can be downloaded from the folder “ICS2 Common Functional System Specifications”. Open the latest version (ICS2-HTI-v3.00.zip) of the folder “ICS2-HTI”, download it and select the folder ”ICS-HTI-IE”. Under the subfolder ”HTI-IEs", you can choose whether to view the data contents in text format (RTF) or in spreadsheet format (XLS).

The data content of each message is in a separate file. The message abbreviation is used as the file name. The abbreviations of the declaration messages used in different modes of transport as well as the message names are found on this page.

When a company has been issued an EORI number in Finland, the application for message exchange customer status for ICS2 declarations shall also be sent to Finnish Customs. If you use an IT service provider for sending and receiving messages, you do not have to apply for message exchange customer status for ICS2.

1. Send the application

Send a free-form email to the Customs Authorisation Centre at lupakeskus(at)tulli.fi. Include the following information in the application:

- the name and EORI number of your company

- one of the following roles in which you are submitting declarations:

- carrier

- express operator

- postal operator

- house level filer

- representative

- IT service provider

- email address of the person in charge of the testing

- person responsible for message exchange: name, phone number and Email address.

Customs will send you instructions on how to create an EU Login for the person in charge of the testing. After creating the EU Login, the person in charge of the testing will notify Customs’ international helpdesk at hd(at)tulli.fi of it.

Customs will register the details of the company in the Commission’s centralised Identity and Access Management System (IAM). Customs will notify the person in charge for the testing of it. The person in charge of the testing shall use the EU Login to log into the Commission’s IAM System, accept the provided details and save authorisation details. Then the person can log into the ICS2 service (STI-STP) used for the testing. Users log in to the ICS2 service via the EU Trader Portal. Alternatively, the person in charge of the testing can, in the IAM System, authorise some other person to use the ICS2 service (STI-STP).

2. Customs Business Information can provide consultation

After receiving the application, Customs Business Information will contact the customer to ask if there is a need for consultation regarding testing arrangements and obtaining a service certificate.

3. Obtain a server certificate

Obtain a server certificate either from the DVV (the Digital and Population Data Services Agency) (recommendation) or from some other certifier approved by the Commission. If you use a server certificate issued by some other certifier than the DVV, register the certificate in the Commission’s UUM&DS Admin system. The same certificate is used both for sending messages and in the message testing and production system.

4. Preparations for the testing

Start the customer testing by logging into the EU Trader Portal with your EU Login username and your company’s details. Then select the ICS2 service, called STI-STP (Shared Trader Interface-Shared Trader Portal) in the EU Trader Portal.

After identification, fill in the details of the message exchange customer under “Manage Preferences”. Fill in the following details:

- Actor type, the role in which the customer sends declarations and receives notifications from the Commission. On the basis of the role, the test automation will later suggest the test cases that the actor must carry out.

- A message exchange customer logged in as a test customer must choose declarant as the type.

- Configuration details, e.g.

- the message exchange customer’s own URL

- whether the message exchange customer is going to retrieve the response notifications from the Commission’s system or whether the Commission should send the response notifications automatically.

5. Testing

Customs’ international helpdesk (hd(at)tulli.fi) will provide support regarding testing. From your own system, send the test cases that the ICS2 service (STI-STP) has suggested. Provide your company’s own details as “Declarant” details and use your company’s certificate. In the service, you can see how the testing proceeds.

After the testing, notify Customs that the testing has been completed. Customs will then send you a decision on registration.

6. Make sure that presentation notifications are submitted to Finnish Customs.

If your company submits not only entry summary declaration messages to the ICS2 system, but also presentation notifications via message exchange, the presentation notifications shall be submitted to the Customs Clearance System of Finnish Customs. To do this, your company must apply for message exchange customer status from Finnish Customs and test the submission of presentation notifications with Finnish Customs. Read more about testing messages with Finnish Customs.

7. Starting production use

Log into the ICS2 service (STI-STP) via the EU Trader Portal. Logging into the service requires Suomi.fi identification and the mandate “Customs clearance”. The details saved by you in this service earlier, during the testing phase, are not automatically transmitted to the production environment, so you must provide your contact details in the service, as well as the actor types, roles and configuration details to be used in production.

| Message number | Amendment message number | Entry summary declaration | Operator responsible for the declaration |

| IE3F20 | IE3A20 | Air cargo (general) – Complete dataset lodged pre-loading |

Carrier |

| IE3F21 | IE3A21 | Air cargo (general) – Partial dataset – Master air waybill lodged pre-arrival |

Carrier |

| IE3F22 | IE3A22 | Air cargo (general) – Partial dataset – House air waybill lodged pre-arrival — Partial dataset provided by a person pursuant to Article 127(6) of the Code and in accordance with Article 113(1 |

House level filer |

| IE3F23 | IE3A23 | Air cargo (general) — Partial dataset — Minimum dataset lodged pre- loading in accordance with Article 106(1) second subparagraph of Delegated Regulation (EU) 2015/2446 without master air waybill reference number | House level filer |

| IE3F24 | IE3A24 | Air cargo (general) — Partial dataset — Minimum dataset lodged pre- loading in accordance with Article 106(1) second subparagraph of Delegated Regulation (EU) 2015/2446 with master airwaybill reference number | House level filer |

| IE3F25 | - | Air cargo (general) — Partial dataset — Master air waybill reference number lodged pre-loading in accordance with Article 106(1) second subparagraph of Delegated Regulation (EU) 2015/2446 | House level filer |

| IE3F26 | IE3A26 | Air cargo (general) — Partial dataset — Minimum dataset lodged pre- loading in accordance with Article 106(1) second subparagraph of Delegated Regulation (EU) 2015/2446 and containing additional house air waybill information | House level filer |

| IE3F27 | IE3A27 | Air cargo (general) — Complete dataset lodged pre-arrival | Carrier |

| IE3F28 | IE3A28 | Air cargo (general) — Complete dataset lodged pre-loading – Direct air waybill | Carrier |

| IE3F29 | IE3A29 | LAir cargo (general) — Complete dataset lodged pre-arrival – Direct air waybill | Carrier |

| Message number | Amendment message number | Entry summary declaration | Operator responsible for the declaration |

| IE3F40 | IE3A40 | Postal consignments – Partial dataset – Road master transport document information | Carrier / road |

| IE3F41 | IE3A41 | Postal consignments – Partial dataset – Rail master transport document information | Carrier / rail |

| IE3F42 | IE3A42 | Postal consignments – Partial dataset - Master air waybill containing necessary postal air waybill information lodged in accordance with the time-limits applicable for the mode of transport concerned | Carrier / air |

| IE3F43 | IE3A43 | Postal consignments — Partial dataset — Minimum dataset lodged preloading in accordance with Article 106(1) second subparagraph and in accordance with Article 113(2) | Postal operator |

| IE3F44 | IE3A44 | PPostal consignments — Partial dataset — Receptacle identification number lodged pre-loading in accordance with Article 106(1) second subparagraph and in accordance with Article 113(2) | Postal operator |

| IE3F45 | IE3A45 | Postal consignments – Partial dataset – Master bill of lading only | Carrier / sea |

| Message number | Amendment message number | Entry summary declaration | Operator responsible for the declaration |

| IE3F30 | IE3A30 | Express consignments — Complete dataset lodged pre-arrival | Express operator |

| IE3F31 | IE3A31 | Express consignments on Air cargo (general) – Complete dataset lodged pre-arrival by the express carrier | Carrier |

| IE3F31 | IE3A32 | Express consignments — Minimum dataset to be lodged pre-loading in relation with situations defined in Article 106(1) second subparagraph | Express operator |

| IE3F33 | IE3A33 | Express consignments on air cargo general – Partial dataset – House air waybill lodged pre-arrival by a person pursuant to Article 127(6) of the Code and in accordance with Article 113(1) | Express operator |

| IE3F34 | IE3A34 | Express consignments on road – Complete dataset lodged pre-arrival | Express operator |

| Message number | Amendment message number | Entry summary declaration | Operator responsible for the declaration |

| IE3F10 | IE3A10 | Sea and inland waterways – Complete dataset – Straight bill of lading containing the necessary information from consignee | Carrier |

| IE3F11 | IE3A11 | Sea and inland waterways – Complete dataset – Master bill of lading with underlying house bill(s) of lading containing the necessary information from consignee at the level of the lowest house bill of lading | Carrier |

| IE3F12 | IE3A12 | Sea and inland waterways – Partial dataset – Master bill of lading only | Carrier |

| IE3F13 | IE3A13 | Sea and inland waterways – Partial dataset – Straight bill of lading only | Carrier |

| IE3F14 | IE3A14 | Sea and inland waterways – Partial dataset – House bill of lading only | House level filer |

| IE3F15 | IE3A15 | Sea and inland waterways – Partial dataset – House bill of lading with the necessary information from consignee | House level filer |

| IE3F16 | IE3A16 | Sea and inland waterways – Partial dataset – Necessary information required to be provided by consignee at the lowest level of transport contract (Lowest house bill of lading where the master bill of lading is no straight bill of lading) | House level filer |

| IE3F17 | IE3A17 | Sea and inland waterways – Partial dataset – Necessary information required to be provided by consignee at the lowest level of transport contract (straight bill) | House level filer |

| Message number | Amendment message number | Entry summary declaration | Operator responsible for the declaration |

| IE3F50 | IE3A50 | Road mode of transport | Carrier |

| IE3F51 | IE3A51 | Rail mode of transport | Carrier |

| Message number | Message name | Who submits and why? |

| IE3Q01 | Do Not Load Request (DNL) | Customs notifies that the goods cannot be brought into the Union. |

| IE3Q02 | LAdditional Information Request (RfI) | Customs requests additional information from the person filing. |

| IE3Q03 | High Risk Cargo & Mail screening request (RfS) | Customs requests screening results from the place of departure. |

| IE3Q04 | Invalidation Request | The person filing requests invalidation from Customs. |

| IE3Q05 | EENS Consultation | An operator can request ENS information from Customs, if the operator has the access rights to the information. |

| IE3R01 | ENS Registration Response | Customs notifies the registration of the ENS filing and the MRN issued to it. |

| IE3R02 | Additional information response | The person filing sends the requested additional information to Customs. |

| IE3R03 | High Risk Cargo & Mail screening response | The person filing sends the requested screening results to Customs. |

| IE3R04 | Arrival Registration Response | Customs notifies the registration of the arrival notification and the MRN issued to it. |

| IE3R07 | Invalidation Acceptance Response | Customs notifies that the ENS filing has been invalidated, either after the submission of an invalidation request or 200 days after the submission of the ENS filing, if no arrival notification has been submitted for the goods. |

| IE3R08 | ENS Consultation results | Customs communicates ENS information requested by the operator and in accordance with the operator’s access rights. |

| IE3N01 | ENS lifecycle validation error notification | Customs notifies that the submitted message has errors that require an amendment message. |

| IE3N02 | ENS Not complete notification | Customs communicates to the carrier that all house level filers have not submitted their own ENS filings. |

| IE3N03 | Assessment complete notification | Customs notifies that that the processing of the ENS filing and the risk assessment are complete. |

| IE3N04 | Additional information request notification | Customs has requested additional information from the person filing and communicates this to the carrier. |

| IE3N05 | High Risk Cargo & Mail screening request notification | Customs has requested screening results from the person filing and communicates this to the carrier. |

| IE3N06 | Arrival notification | The operator notifies Customs of the arrival of the means of transport. |

| IE3N07 | House consignment in incorrect state notification | After arrival, Customs notifies of the house level transport documents that could not be accepted as arrived. |

| IE3N08 | Control notification | After arrival, Customs notifies of goods controls to be performed. |

| IE3N09 | Authorised Economic Operator control notification | Customs notifies the AEO in advance of the control. |

| IE3N10 | Amendment Notification | After the amendment message, Customs notifies that the processing of the ENS filing and the risk assessment are complete. |

| IE3N11 | ENS pending notification | Customs notifies house level filer: waiting for ENS. |

| IE3N12 | Error notification | Customs notifies that the lodged ENS has been rejected. |

Declarations for goods arriving from EU ports and airports – now

For goods arriving by sea or air, the following must be submitted to Customs either via the Customs Clearance Service or via message exchange:

- a temporary storage declaration

- a presentation notification.

In the temporary storage declaration, either the goods description or the commodity code at the level of at least six digits must be provided.

Electronic notifications can be used for movements between temporary storage facilities, when a temporary storage declaration introduced after 5 November 2022 has been submitted for the goods. The use of electronic notifications regarding movements must begin no later than on 1 March 2023.

Changes to declarations for goods arriving from EU ports and airports

The commodity code must be provided as a mandatory detail in the temporary storage declaration at the latest when transport companies have started using the new entry summary declarations. This varies depending on the mode of transport. In air traffic, the new entry summary declarations will be introduced on 1 March 2023, and transport companies will have a transition period until 1 June 2023 for changing over to the new declarations. As for other modes of transport, the aim is to introduce the new entry summary declarations in 2025.

Proving the Union status of goods – now

The Union status of goods worth no more than 15 000 euros can be proved using an invoice or a transport document without endorsement by the customs office of departure. A document proving the Union status of goods worth more than 15 000 euros must be endorsed at the place of departure.

Exit of goods

Union status is verified with a paper document. The document can be, for example, a T2L or T2LF document filled in on copy 4 of a SAD document or some other document accepted in the Union customs legislation, such as an invoice or shipping company’s goods manifest.

The document must be presented to Customs for verification, unless the operator in question has authorised issuer status. A verification by Customs is not required if the matter involves an invoice or transport document regarding Union goods worth no more than 15 000 euros in total.

An authorised issuer can personally verify a document that proves the Union status of goods. However, as an advance notification, the authorised issuer must send by email a copy of the document to unioniasema.ennakkoilmoitus(at)tulli.fi.

Entry of goods

The Union status of goods can be declared to Customs in one of the following ways:

- You declare Union status in a temporary storage declaration.

- You declare Union status in an entry summary declaration (AREX).

- You enter the additional information code ”FIPOU – Presentation of Union goods” in the manifest presentation that you provide after the entry summary declaration submitted to the ICS2 system of the Commission.

- If the goods were taken into temporary storage as other than Union goods, you submit the document proving the Union status of the goods to the temporary storage operator.

- If the goods are in temporary storage at the place of arrival, but not included in temporary storage bookkeeping, you submit the document proving the Union status of the goods to Customs.

Changes to proving the Union status of goods

As of 1 March 2024, the Union status of goods of a value exceeding 15 000 euros must be registered with an electronic declaration in the new EU Proof of Union Status system (PoUS). The MRN issued for the declaration submitted to PoUS must be provided in the presentation notification (FI322) when the goods arrive in Finland.

A declaration in the PoUS system is not required for goods with a maximum value of 15 000 euros.

The change is EU-wide, and it will take place in two stages. The first changes will take effect on 1 March 2024, and subsequent changes are introduced in August 2025.

Establishing the Union status of goods as of 1 March 2024

At the first stage of the renewal, electronic declarations are to be submitted to the Commission’s PoUS system as of 1 March 2024. T2L and T2LF documents can no longer be verified at customs offices.

Moreover, authorised issuers are required to indicate the Union status of goods in the PoUS system. In the future, authorised issuers can no longer prove Union status with a self-confirmed T2L or T2LF document, or with a corresponding trade invoice or transport document. In cases of electronic declarations, authorised issuers are not required to submit an advance declaration to Customs.

Electronic declarations can only be submitted to the EU transaction service, which means that messages cannot be used.

Please note that if an authorised issuer uses a transport document that is the authorised issuer’s goods manifest for establishing Union status, they can continue using the manifest according to the old procedure until 15 August 2025. In such cases, the authorised issuer must submit an advance declaration to Customs regarding the goods manifest they have verified. However, an advance declaration is not required if the authorised issuer is permitted to draft a shipping company’s goods manifest after the ship departs (DA Article 128c).

Changes to proving the Union status of goods as of 1 March 2024

As of 1 March 2024, the Union status of goods of a value exceeding 15 000 euros must be registered with an electronic notification in the new EU Proof of Union Status system (PoUS). Notifications submitted to PoUS will be issued Movement Reference Numbers (MRNs) that must be presented when goods arrive in Finland.

A notification in the PoUS system is not required for goods with a maximum value of 15 000 euros.

The change is EU-wide, and it will take place in two stages. The first changes will take effect on 1 March 2024, and subsequent changes are introduced in August 2025.

Notifications can be submitted by operators who meet the following requirements:

- In certain cases of audit, the operator can arrange an audit for Customs.

- The operator has the required information about the Union status of their goods, as well as documentation required as an attachment to the notification.

- The operator can log in to the EU Trader Portal (Suomi.fi identification, “Customs clearance” authorisation).

For example, a notification can be submitted by a port operator to whom the consignor has given the documentation required for the notification (for example, a transport document or a commercial document). If the notification is submitted by an operator other than the consignor, the party that submits the notification must be able to obtain detailed information on the goods from the consignor if Customs so requires.

The submitter of the notification is responsible for the accuracy of the information they have provided. The document that proves Union status must be kept for at least three years.

Proving the Union status of goods exiting Finland as of 1 March 2024

At the first of the reform, economic operators must submit electronic notifications, that is, request endorsement of Union status through the Commission’s Proof of Union Status system (PoUS). Only travellers can request confirmation of T2L and T2LF documents at customs offices after 1 March 2024.

Notifications must be submitted prior to the departure of goods so that Customs can, if required, control the goods before they exit Finland.

Customs recommends that customers submit notifications also on consignments of a maximum value of 15 000 euros in the PoUS system.

Moreover, authorised issuers are required to indicate the Union status of goods electronically in the PoUS system. In the future, authorised issuers can no longer prove Union status with a self-confirmed T2L or T2LF document, or with a corresponding trade invoice or transport document. In cases of electronic notifications, authorised issuers are not required to submit an advance notification to Customs.

Electronic declarations can only be submitted to the EU Trader Portal, which means that messages cannot be used.

Submitters of electronic notifications must forward the MRN of the notification to the transport operator that presents the Union goods at their destination. If an electronic notification has not been submitted for goods of a maximum value of 15 000 euros, the transport operator will need a document indicating the value of the consignment along with other information.

If an authorised issuer uses a customs goods manifest for proving Union status, they can continue using the manifest in the old method of declaration until 15 August 2025 (Delegated Act, Article 126a). In such cases, the authorised issuer must submit an advance notification to Customs regarding the goods manifest they have verified. However, an advance declaration is not required if the authorised issuer is permitted to draft a shipping company’s goods manifest after the ship departs (Delegated Act, Article 128c).

Proving the Union status of goods arriving in Finland as of 1 March 2024

An electronically submitted Union status notification must always be discharged electronically. If an electronic PoUS notification has been submitted for the goods, the MRN given to the notification is to be presented electronically to Customs at the arrival location.

You should present Union goods arriving in Finland under an MRN as follows:

- 1 March–24 May 2024: in the Commission’s PoUS system.

- As of 25 May 2024, by submitting a presentation notification in the Customs Clearance Service or in message format (FI332).

If an electronic (PoUS) notification proving the Union status of goods has not been submitted, the goods can be presented as follows:

- If Union status is proven with an authorised issuer’s goods manifest approved for customs use (possible until August 2025):

- Additional information code FIVAA is used in the temporary storage declaration, and the customs status of the goods is indicated as “C”.

- In the entry summary declaration (AREX), document code 2YMM is used as an attachment for each consignment, and the authorised issuer licence number from Customs is the code explanation. The customs status of goods is indicated as “C”.

- In the arrival notification that follows the entry summary declaration (ICS2), additional information code FIPOU is used.

- If Union status is proven with a valid T2L document, T2LF document or corresponding documentation issued before 1 March 2024:

- Additional information code FITAA is used in the temporary storage declaration, and the customs status of the goods is indicated as “C”.

- In the entry summary declaration (AREX), document code 2YMM is used as an attachment for each consignment, and “IA Art. 199” is the code explanation. The customs status of goods is indicated as “C”.

- If the maximum value of Union goods is 15 000 euros, and an electronic PoUS notification has not been submitted for them:

- Additional information code FITAA is used in the temporary storage declaration, and the customs status of the goods is indicated as “C”.

- In the entry summary declaration (AREX), document code 2YMM is used as an attachment for each consignment, and “IA Art. 199” is the code explanation. The customs status of goods is indicated as “C”.

- In the presentation notification that follows the entry summary declaration (ICS2), additional information code FIPOU is used.

If an electronic PoUS notification proving the Union status of goods has not been submitted and the goods have not been otherwise presented as Union goods, they comprise temporarily stored goods. However, if the items comprise Union goods and this can be proven, take the following steps:

- If the goods are presented for unloading in temporary storage, present the proof to the temporary warehouse operator. The warehouse operator submits the required documentation to Customs.

- Proof is to be sent directly to Customs if the goods have not been presented for temporary storage.

As of 25 May 2024, in situations where goods are presented upon arrival using the Customs Clearance Service or a message, Customs notifies the submitter of the notification about the approved presentation of Union goods. The warehouse operator can check the MRN Search whether the goods have been presented. Furthermore, the warehouse operator receives an “Import of goods is allowed” message (FI329) if the warehouse identifier is included in the presentation notification and the warehouse operator is a message customer of Customs.